When curious about what a career at Pacific Life entails, reviewing a Pacific Life employee handbook example is invaluable. This article zeroes in on exactly that—key elements such as company standards, employee benefits, and workplace expectations are outlined for those interested in understanding the fundamental aspects of working at Pacific Life.

Key Takeaways

- Pacific Life Insurance Company, with over 150 years in business, upholds principles like People, Accountability, Customer Focus, and Innovation, shaping its inclusive and results-driven corporate culture.

- Employees at Pacific Life are provided with a comprehensive handbook detailing company policies, benefits like health insurance and 401K plans, and clear workplace expectations encouraging respect and high performance.

- Pacific Life offers a range of Employee Support Programs including wellness initiatives, professional development opportunities, and Employee Assistance Programs to ensure employees’ well-being and career growth.

Fortune 500 Companies Employee Handbook

Welcome to the comprehensive guide that outlines the policies, procedures, and expectations detailed in the Fortune 500 Companies Employee Handbook. This invaluable resource serves as a vital reference for employees across our esteemed organization. Within these pages, you will find essential information regarding our company culture, code of conduct, and guidelines that shape the professional landscape for each member of our diverse and talented workforce. It is imperative that all employees familiarize themselves with the content herein, as adherence to these principles is fundamental to maintaining the integrity and success of our organization. Embrace this handbook as a roadmap to a successful and rewarding career within our Fortune 500 company.

Understanding Pacific Life Insurance Company

Established in 1868 as Pacific Mutual Life, Pacific Life Insurance Company has provided a wide array of insurance products to its customers for more than 150 years. The company approaches its work with a mission to ensure the honest and fair treatment of each other, customers, and the business. Upholding fundamental principles such as:

- People

- Accountability

- Customer Focus

- Integrity

- Financial Success

- Innovation

- Community

Pacific Life strives to maintain a corporate culture that is both inclusive and results-driven.

These principles not only guide the company’s strategic decisions but also shape the experiences of Pacific Life employees. What does it entail to be a Pacific Life employee? What kind of rights, benefits, and expectations come with the position? We will delve into these queries in the following sections.

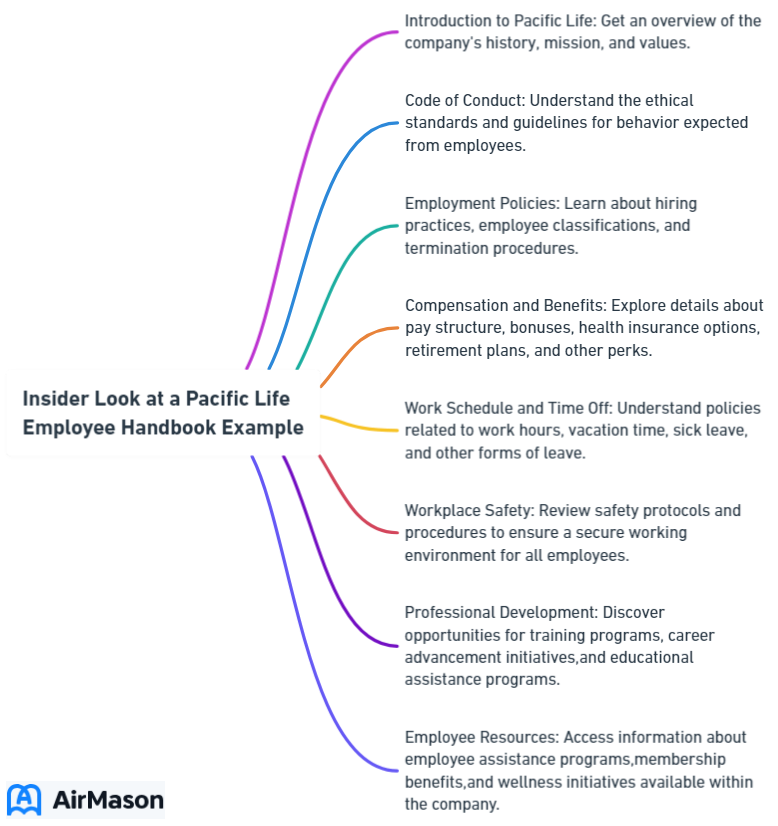

Key Elements of a Pacific Life Employee Handbook

An employee handbook serves as a guidebook, outlining policies, benefits, and expectations, effectively setting the tone for a company’s culture and values.

Pacific Life’s Employee Handbook also serves this purpose, equipping employees with vital information to understand their roles and obligations within the organization.

Company Policies

At Pacific Life, the company policies are clearly outlined in the Code of Business Conduct and the Employee Handbook. These documents detail the rights and responsibilities of employees, emphasizing the importance of maintaining a safe and healthy work environment. The company’s policies include:

- Equal employment opportunity

- Anti-harassment and anti-discrimination

- Workplace safety

- Confidentiality and data protection

- Ethical business practices

- Social responsibility

These policies reflect Pacific Life’s commitment to its core principles.

In addition to the standard rights and responsibilities, Pacific Life’s company policies include a comprehensive benefits package. These benefits include:

- Medical, dental, and vision insurance

- 401K and retirement plans

- Life and disability insurance

- Dependent care and flexible spending accounts

Pacific Life also acknowledges the changing dynamics of the work environment, implementing a Work from Home (WFH) policy to support remote work arrangements.

Employee Benefits

The benefits package at Pacific Life is structured to bolster the financial and personal well-being of its workforce. It’s not just about health insurance; Pacific Life takes a holistic approach to employee benefits. From medical, dental, and vision insurance to life and disability insurance, the company’s comprehensive benefits package caters to a variety of employee needs.

In addition to health benefits, Pacific Life offers robust retirement plans, featuring a 401K plan with company contributions and matches. The company also provides a comprehensive paid time off program, which is determined by the employee’s job level and years of service. It even includes dedicated time off for financial planning purposes.

To facilitate work-life balance, Pacific Life provides an Employee Assistance Program, featuring free short-term counseling and work/life services.

Workplace Expectations

Pacific Life’s Code of Conduct sets clear workplace expectations for all employees. The company fosters a work environment that promotes respect, fairness, and dignity and is devoid of violence, harassment, and intimidation. Pacific Life respects the uniqueness and diversity of its workforce, recognizing that an inclusive and respectful work environment is essential for its success.

In addition to behavioral expectations, Pacific Life sets high performance standards. Employees are expected to:

- Demonstrate courage by asking questions, voicing concerns, and holding themselves accountable

- Champion freedom, agility, and team engagement

- Be proactive and contribute meaningfully to the company’s objectives

The Connection Between Third Parties and Pacific Life

In the interconnected business landscape of today, collaborations with third parties are gaining increasing significance. Pacific Life leverages relationships with third-party entities to foster a challenging, inclusive, collaborative, and results-oriented work environment. How does Pacific Life engage with third parties like brokers and financial advisors? How does it guarantee regulatory compliance in its interactions with these entities?

Let’s take a closer look.

Working with Brokers

Brokers play a significant role in the operations of Pacific Life. They use the broker portal to access their book of business and acquire insights, helping to market Pacific Life’s products. Brokers primarily earn income through commissions, assisting clients in securing their loved ones through life insurance.

Pacific Life aids its brokers via Pacific Life Workforce Benefits, providing a unified experience that covers group benefits from quotes to claims. Brokers commonly distribute variable insurance products, mutual funds, and group insurance products like dental, vision, and life insurance on behalf of Pacific Life.

Collaborating with Financial Advisors

Financial advisors are key partners in Pacific Life’s operations. They:

- are independent professionals affiliated with financial planning firms and securities broker-dealers

- are responsible for selling Pacific Life’s insurance products

- offer advisory annuities

- support independent Financial Professionals associated with financial planning firms

- act as a resource for Registered Investment Advisors (RIAs)

Financial advisors assist Pacific Life clients with comprehensive financial planning, providing guidance on strategies for:

- Retirement income

- Legacy planning

- Social security planning

- Tax planning

- Estate planning

Their role is integral to the seamless delivery of Pacific Life’s products to clients.

Third-Party Compliance

Third-party compliance is a crucial aspect of Pacific Life’s operations. The assurance that third-party associations adhere to federal and state regulations is important in overseeing and minimizing risks related to data privacy and security. Pacific Life ensures third-party compliance by requiring these entities to contact Pacific Life’s Enterprise Compliance department to report any actual or suspected violations of business conduct.

Failure to maintain third-party compliance can have serious repercussions, including:

- The risk of retaliation against individuals who report concerns or participate in investigations

- Unauthorized use of personally-owned devices by third-party personnel

- Disclosure of personal information to third parties without proper consent

Pacific Life takes all necessary steps to mitigate these risks and ensure the privacy, confidentiality, and interests of all stakeholders.

Universal Health Services Employee Handbook Example

In the realm of workplace guidelines and regulations, the Universal Health Services Employee Handbook example serves the best model. This comprehensive document outlines the company’s policies, procedures, and expectations, providing employees with a clear roadmap for navigating their professional journey within the organization. The Universal Health Services Employee Handbook exemplifies best practices in fostering a healthy work environment, emphasizing the importance of collaboration, diversity, and individual well-being. Employees can refer to this handbook as a valuable resource for understanding their rights, responsibilities, and the overall culture that defines Universal Health Services. As a beacon of clarity, this handbook stands as a testament to the organization’s commitment to transparent communication and the promotion of a supportive and inclusive workplace.

Internal Revenue Considerations for Pacific Life Employees

Working for a company like Pacific Life brings certain tax considerations. Pacific Life employees should understand the types of income that are taxable, the tax-beneficial advantages that Pacific Life provides, and the tax filing obligations they must fulfill.

Taxable Income

Various types of income are subject to taxation for Pacific Life employees. This includes:

- Income from qualified contracts, such as IRAs, which result in 100% taxable distributions

- Nonqualified contracts, which have taxable earnings above the cost basis

- Bonuses or incentives received by Pacific Life employees, which are also considered taxable income.

While allowances provided by Pacific Life, such as Social Security benefits and annuity earnings, are liable to income tax, the proportion of the benefits subjected to taxation depends on the individual’s overall income. Understanding these taxation rules is crucial for Pacific Life employees, as it allows them to effectively plan for their tax obligations.

Tax-Advantaged Benefits

Pacific Life’s comprehensive benefits package not only caters to employees’ financial requirements but also offers them tax benefits. These benefits include tax-deferred earnings on annuities, tax-free death benefit proceeds on life insurance, and tax breaks on contributions to IRAs and 401(k)s.

The retirement plans offered by Pacific Life allow employees to accumulate savings for their post-work years while enjoying tax benefits. Employees can invest in annuities, which provide tax-deferred growth and the potential for tax-free withdrawals during retirement.

Additionally, the health savings accounts provided by Pacific Life offer tax advantages, including tax-deductible contributions and tax-free distributions for qualified medical expenses.

Filing Requirements

There are certain tax filing obligations for Pacific Life employees. The company provides tax-filing support and resources to its employees, offering various options to complete forms and share information with Pacific Life. The company is obliged to send the 1099-R form by January 31 of each year, either electronically or by U.S. Mail.

Pacific Life employees may also have an obligation to submit state taxes, depending on the state in which they are employed. Should an employee fail to meet the tax filing deadline, they may incur a penalty amounting to 5% of the outstanding taxes for every month or fraction of a month that the tax return is overdue, with a maximum penalty of 25% of the outstanding taxes.

What You Would Like to Know About Pacific Life’s Employee Support Programs

Pacific Life extends more than just competitive compensation and benefits to its workforce. The company has a range of support programs designed to foster the well-being of its employees both inside and outside the workplace.

Wellness Initiatives

In recent years, Pacific Life has made significant strides in promoting wellness among its employees. The company’s wellness programs extend beyond the traditional health and fitness initiatives to include mental health support and flexible work arrangements. This holistic approach encourages employees to maintain a healthy work-life balance and prevent burnout.

Pacific Life’s wellness initiatives are not just about promoting physical health. The company understands that mental well-being is equally important. Therefore, Pacific Life’s Employee Assistance Program offers free short-term counseling and other work/life services to employees, helping them manage personal challenges such as:

- family and relationship issues

- anxiety

- stress

- grief and loss

- financial concerns

and more.

Professional Development Opportunities

Pacific Life is dedicated to promoting the professional development of its employees. The company offers a range of programs designed to help employees enhance their skills and advance their careers. From structured programs like the Executive Mentorship Program and the Summer Actuarial Internship Program to educational assistance for skills enhancement or degree completion, Pacific Life provides ample opportunities for professional development.

In addition to offering structured programs, Pacific Life also provides resources for continuous learning. Employees have access to:

- Online classes

- Seminars

- Webinars

- Specialized training programs like the Mainframe Academy

These resources enable employees to stay up-to-date with the latest industry trends and enhance their professional competencies.

Employee Assistance Programs

Pacific Life’s Employee Assistance Programs (EAPs) aim to offer all-encompassing support to its employees. These programs offer free short-term counseling and work/life services, addressing a range of personal issues from family and relationship matters to anxiety.

Access to these EAPs is straightforward. Employees can access these services through their health care provider, ensuring that they and their household members have the support they need when they need it most. While these programs do have certain limitations, they play a crucial role in fostering a supportive and understanding workplace culture at Pacific Life.

VMware Employee Handbook Example

In this illustrative VMware Employee Handbook Example, the guidelines and policies exemplify the company’s commitment to fostering a positive and inclusive work environment. The VMware Employee Handbook serves as a comprehensive resource, outlining the expectations, rights, and responsibilities of every employee. Through this example, VMware demonstrates its dedication to transparency and communication within the workplace. Employees can refer to the handbook to gain insights into the company culture, code of conduct, and procedures, ensuring a harmonious and productive work experience. The VMware Employee Handbook exemplifies the organization’s commitment to providing a clear framework for success and mutual respect among its diverse workforce.

Summary

From understanding the rich history of Pacific Life Insurance Company to delving into the nitty-gritty details of the employee handbook, third-party relations, tax considerations, and employee support programs, we have taken a comprehensive look at what it’s like to be a part of the Pacific Life family. It is evident that Pacific Life is not just a leading insurance company; it is a company that values its employees, fosters a culture of respect and inclusivity, and remains committed to providing exceptional service to its clients.

Frequently Asked Questions

What are the key elements of the Pacific Life Employee Handbook?

The key elements of the Pacific Life Employee Handbook include company policies, employee benefits, and workplace expectations, serving as a comprehensive guide for employees to understand their rights, responsibilities, and available benefits.

How does Pacific Life collaborate with third-party entities?

Pacific Life collaborates with brokers and financial advisors to sell its insurance products, ensuring compliance with regulations.

What are the tax considerations for Pacific Life employees?

Pacific Life employees should be aware of the types of income subject to taxation, tax-advantaged benefits offered by Pacific Life, and tax filing requirements. Be diligent in understanding and complying with these tax considerations to ensure financial stability.

What support programs does Pacific Life offer to its employees?

Pacific Life offers wellness initiatives, professional development opportunities, and employee assistance programs to support the well-being of its employees. These programs are designed to cater to their needs both inside and outside the workplace.

How does Pacific Life’s Employee Assistance Program support employees?

Pacific Life’s Employee Assistance Program supports employees by offering free short-term counseling and work/life services to help manage personal challenges like family and relationship issues and anxiety.

Important Disclaimer:

The article presented here does not serve as a representation of the company’s actual employee handbook mentioned in this article.

Our discussions and insights regarding employee handbook are based on assumptions about what may be considered significant in the companies’ policies. These assumptions are drawn from available information and industry knowledge. Readers are advised that the content provided is for informational purposes only and should not be construed as an exact reflection of any company’s official policies or procedures. For precise and accurate details regarding a company’s employee handbook, individuals should refer directly to the company’s official documentation or consult with appropriate representatives.

Please be aware that the content on this page has been generated by using artificial intelligence language models and may contain errors, inconsistencies, or outdated information. It is provided as-is without any warranties or guarantees of accuracy. We strongly recommend using this content as a starting point for further research. We disclaim any liability for damages or losses resulting from the use or reliance on this content.