Key Takeaway:

- JPMorgan Chase emphasizes integrity, respect, and accountability in their ethical standards and expectations outlined in their Employee Handbook.

- The Code of Conduct covers various topics and emphasizes the commitment to diversity and inclusion, while also maintaining a zero-tolerance policy for discrimination and harassment.

- Familiarization and adherence to the Code of Conduct are essential for employees, as it provides resources and support, maintains trust and confidence, and promotes a culture of integrity and ethical behavior through open communication and reporting mechanisms.

- High ethical standards are extended not only to employees but also to suppliers, partners, and stakeholders, with an emphasis on legal and regulatory compliance and responsible business practices.

- The Employee Handbook provides detailed information about benefits and compensation programs, access to summary plan descriptions, employment verification for former employees, and limitations on personal or character statements/references.

- Employees have specific responsibilities after employment ends, including returning firm assets, maintaining confidentiality, refraining from insider trading, and assisting with investigations and litigation, with additional restrictions for senior-level employees.

- The “As You Leave” guide provides information for departing employees, including reporting violations of the Code of Conduct.

- The onboarding process for new employees at JPMorgan Chase includes an emphasis on diversity and growth opportunities, familiarization with the company’s intranet and programs, benefits enrollment, IT risk management, and anti-money laundering training, and an overview of the company’s structure and corporate groups.

- JPMorgan Chase aims to provide a comprehensive employee programs and services to support the well-being and success of their employees.

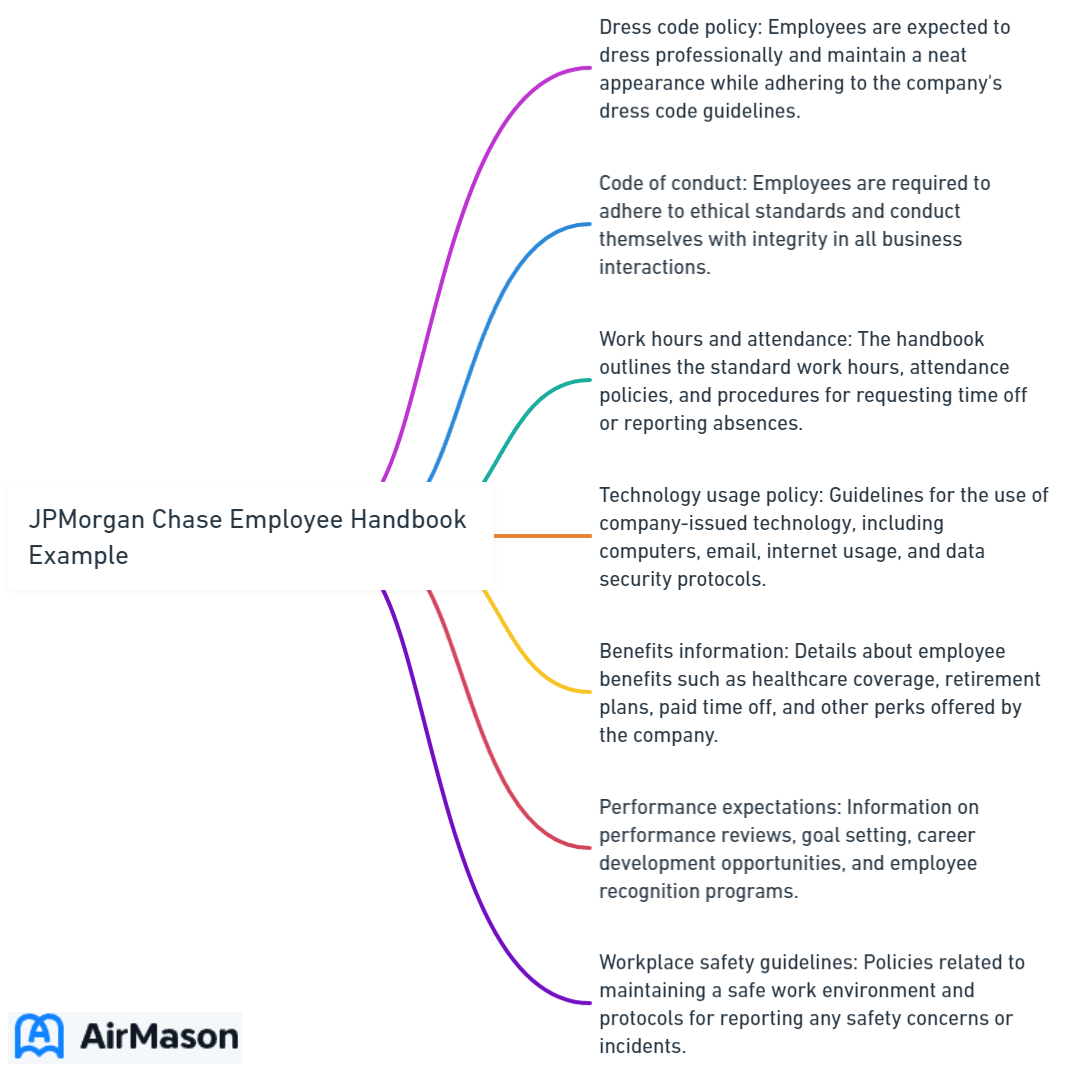

Introduction to JPMorgan Chase Employee Handbook

JPMorgan Chase Employee Handbook serves as a crucial guide, providing employees with vital information and policies. In this section, we will explore the introduction to the handbook, which will familiarize employees with its purpose and structure. From understanding company policies to learning about employee rights and expectations, this sub-section will set the foundation for a successful journey within JPMorgan Chase.

Sub-heading

Text: JPMorgan Chase’s Employee Handbook provides guidance to staff about ethics, expectations, and resources. It has sub-headings to help readers find information.

They:

- Navigate the content.

- Organize it in a structured way.

- Make it user-friendly and easy to understand.

- Highlight important areas.

- Maintain consistency.

Staff need to know all sections, including sub-headings, to understand expectations and follow ethical standards. The sub-headings guide employees and give structure to the Handbook. This is according to ‘1. Introduction to JPMorgan Chase Employee Handbook’.

Sub-heading

The JPMorgan Chase Employee Handbook is a comprehensive guide to the company’s policies and guidelines. It includes sub-headings that cover distinct aspects of employee policies, ranging from ethical standards and expectations to benefits and services.

This handbook promotes a transparent and inclusive work environment. Diversity and inclusion are core values, and any form of discrimination and harassment is not tolerated. Ethical standards are also extended to suppliers, partners, and stakeholders.

The Benefits and Services Guide provides detailed information about the company’s various benefit programs. Summary plan descriptions, employment verification, and other resources are available to employees.

New hires are guided through their onboarding process with this handbook. They get familiar with the company’s policies, programs, structures, benefits enrollment, IT risk management protocols, and corporate groups’ overview.

It is based on ‘1. Introduction to JPMorgan Chase Employee Handbook’, an article listing the key sections covered.

Ethical Standards and Expectations

In the Ethical Standards and Expectations section, we’ll explore JPMorgan Chase’s unwavering commitment to integrity, respect, and accountability. We’ll also dive into the comprehensive Code of Conduct, covering a range of topics. Additionally, we’ll discuss the company’s dedication to fostering diversity and inclusion, as well as their zero tolerance policy for discrimination and harassment. Get ready to discover the core values and ethical guidelines that drive JPMorgan Chase’s operations.

Emphasis on Integrity, Respect, and Accountability

Integrity, respect, and accountability are essential for JPMorgan Chase. These values must be upheld to maintain trust and confidence.

- Integrity is living honestly, ethically, and responsibly.

- Respect is valuing each other’s perspectives, ideas, and contributions.

- Accountability is taking ownership of actions and decisions.

JPMorgan Chase has a Code of Conduct to guide ethical standards. Its commitment to diversity and inclusion encourages innovation. Discrimination and harassment are not tolerated.

These principles are integral to JPMC’s corporate identity. Open communication is encouraged, as it strengthens trust and fairness. Employees have access to reporting mechanisms without fear of retaliation.

Adhering to these values promotes a positive and inclusive work environment. JPMorgan Chase stands as an example of this.

Topics Covered in the Code of Conduct

JPMorgan Chase’s code of conduct contains topics on ethical practices. It stresses integrity, respect, and accountability. The firm also has zero tolerance for discrimination and harassment.

They offer resources and support to staff so they can understand the code. It’s a major part of keeping trust between stakeholders. The code is regularly reviewed and updated to stay current. Adhering to the code builds up a culture of ethical behavior. Open communication and reporting processes help transparency.

JPMorgan Chase expands their ethical standards to suppliers, partners, and other stakeholders. High standards are necessary for legal and regulatory compliance. The code of conduct gives clear expectations and guides decision-making based on ethics. This helps create a culture of trust, accountability, and responsible business practices.

It’s a True Fact that following JPMorgan Chase’s code of conduct is essential for sustaining trust in the organization.

Commitment to Diversity and Inclusion

At JPMorgan Chase, diversity and inclusion are essential to our values and Code of Conduct. We think that when we embrace different perspectives and backgrounds, our decision-making is better and our workforce is more productive and innovative.

We understand that diversity includes a range of factors such as race, gender, age, sexual orientation, disability, and cultural background. Our aim is an environment where everyone feels respected, empowered, and appreciated for their skills and experiences.

We have a clear Code of Conduct that prohibits any form of discrimination or harassment. We have zero-tolerance for any violations, and employees can report any concerns through our communication and reporting systems. We are committed to creating a diverse and inclusive culture, so we regularly update our Code of Conduct to address any new issues. Additionally, we provide resources to help employees learn more about diversity and inclusion.

By having a culture that celebrates diversity and inclusion, we make our employees more engaged and satisfied, and we can better serve our clients in a diverse global marketplace. With our employees’ commitment to upholding these principles, we make sure everyone feels valued for their unique contributions.

Join us in fostering diversity and inclusion – together, we can bring positive change to our company and the communities we serve. At JPMorgan Chase, discrimination and harassment are not tolerated – they’d win gold if those were Olympic sports!

Zero Tolerance Policy for Discrimination and Harassment

At JPMorgan Chase, a zero tolerance policy for discrimination and harassment is strictly enforced. No form of discrimination or harassment is accepted. This policy makes it clear that respect and inclusion are expected from all employees.

It is required that everyone follows the Code of Conduct. This Code is reviewed and updated often to keep employees informed of their responsibilities. Also, employees are encouraged to report any violations of the Code.

The policy is made to be proactive in promoting an environment of integrity and ethical behaviors. This includes upholding high ethical standards when working with suppliers, partners, and stakeholders.

Employees are offered benefits and services to help support a culture of trust, accountability, and responsible business practices. These include compensation programs and resources for former employees. Limitations on personal or character statements/references are also in place.

Familiarization and Adherence to the Code of Conduct

Familiarizing oneself with and adhering to the code of conduct is vital for maintaining trust and confidence within JPMorgan Chase. In this section, we will explore various aspects of this code, including the role it plays in promoting a culture of integrity and ethical behavior. We will also discuss the importance of regular review and updates of the code, as well as the resources and support available for employees. Open communication and reporting mechanisms will also be emphasized to ensure a strong commitment to upholding the code.

Resources and Support for Employees

JPMorgan Chase showers its employees with an array of resources and support to ensure their well-being and career development.

- – Employees can call on a wide range of supportive resources, including counseling, employee assistance programs, and wellness initiatives.

- – There are also learning and development opportunities, such as training and mentorship, to help employees refine their abilities and progress in their jobs.

- – In addition, JPMorgan Chase furnishes financial planning, retirement savings plans, and flexible working arrangements to promote work-life balance.

It is critical that employees take advantage of these resources and support. It helps cultivate a positive work atmosphere and job contentment. By providing resources and support for its employees, JPMorgan Chase wishes to nurture a culture of success and instill loyalty in its workforce.

Nurturing trust and confidence, where the Code of Conduct stands between corporate scandals and corporate gestures.

Role of the Code of Conduct in Maintaining Trust and Confidence

The Code of Conduct is essential for trust and confidence at JPMorgan Chase. It sets the ethical standard and helps employees decide what to do. Through integrity, respect, and accountability, the Code builds a culture of truth and responsibility.

Maintaining trust and confidence is key.

It talks about topics like diversity and inclusion, and discrimination and harassment. This way, employees know their obligations. The code also assists them in ethical dilemmas. It encourages them to report violations without fear of being punished. And updates keep the Code relevant in a changing business world.

The Code not only applies to JPMorgan Chase’s employees. It also sets expectations for suppliers, partners, and stakeholders. The role of the code in maintaining trust and confidence covers all company operations.

Overall, the Code of Conduct is vital for trust and confidence. It sets ethical standards, guides decision-making, and encourages accountability. By promoting integrity and open communication, it creates a culture based on trust, accountability, and responsible business practices.

Regular Review and Updates of the Code of Conduct

JPMorgan Chase is dedicated to upholding integrity and ethical behavior. So, they review and update their Code of Conduct regularly. This ensures that the code is up-to-date with changing industry standards and regulations. Employees are made familiar with any changes or updates to the Code, reinforcing their understanding of expectations.

Getting feedback from employees is essential, too! They can identify areas for improvement and communicate any violations or concerns. This encourages transparency and accountability.

Regular reviews and updates show JPMorgan Chase’s commitment to promoting a culture of trust and ethics. Ongoing training and education programs ensure that employees can make informed decisions in line with the organization’s values. This ongoing process equips employees with the guidance and support to uphold these values in their daily activities.

Promotion of a Culture of Integrity and Ethical Behavior

At JPMorgan Chase, a culture of integrity and ethical behavior is highly emphasized. All employees must act with respect, integrity, and accountability. The Code of Conduct covers topics like conflicts of interest, confidentiality, and compliance with laws.

JPMorgan Chase is devoted to fostering diversity and inclusion. They have a strict policy for discrimination and harassment, ensuring every employee feels safe. Resources and support are provided to ensure familiarization and adherence to the Code. Regular updates are done to maintain relevance. Adherence is crucial for trust and confidence among clients, shareholders, employees, and other stakeholders.

Open communication channels are available for reporting any suspicions or concerns about unethical behavior. Employees are encouraged to speak up without fear of retaliation. High ethical standards are also expected from suppliers, partners, and stakeholders. This is for legal compliance and regulatory requirements.

JPMorgan Chase strongly values promoting a culture of integrity and ethical behavior. Policies, training programs, open communication channels, and commitment to diversity and inclusion help create an environment where every employee feels valued. Adhering to the Code of Conduct is essential.

Importance of Adherence to the Code of Conduct

Adhering to the Code of Conduct is essential at JPMorgan Chase. It is necessary for maintaining a culture of ethics and integrity within the organization. The Code sets the basis for employees to act with honesty, respect, and responsibility in their interactions. This shows their dedication to upholding the ethical standards of the company and making a trusted environment for all.

The significance of following the Code of Conduct is immense. It is important for building trust among employees. The Code has guidelines and expectations for ethical decision-making, helping employees in complicated situations with integrity. It covers topics such as conflicts of interest, confidentiality, anti-harassment policies, and legality requirements. Abiding to these standards avoids potential misconduct or harm.

JPMorgan Chase also emphasizes diversity and inclusion within the Code of Conduct. They strive to create an environment where everyone feels appreciated and respected, no matter race, ethnicity, gender identity, age, or background. Following these principles not only encourages fairness and equality, but also enhances collaboration and innovation.

It is also essential to follow the Code of Conduct for legal compliance. Upholding high ethical standards in relationships with suppliers, partners, and stakeholders, JPMorgan Chase makes sure their business practices are legal. This adherence sets clear expectations for responsible behavior throughout the organization.

Adhering to the Code of Conduct is more than just compliance. It is about being ethical in every part of your work at JPMorgan Chase. If you have ethical questions, use the resources available for guidance.

Open communication and reporting systems are available at JPMorgan Chase. We urge you to report any irregularities, and we’ll try not to be too judgmental.

Open Communication and Reporting Mechanisms

JPMorgan Chase encourages its employees to communicate openly and use the reporting mechanisms available. These include a hotline, email, and speaking with a manager or HR department. All reports are kept confidential. This also applies to external stakeholders such as suppliers and partners.

Investigations are done when misconduct is reported. JPMorgan Chase takes action against any violations to maintain an ethical culture.

Open communication is also used to give feedback on process improvements and risk identification. Training sessions are given to emphasize the importance of these processes. This builds trust among team members and stakeholders.

This creates an environment where individuals feel comfortable and empowered to express their thoughts and opinions. The internal and external reporting mechanisms help ensure integrity, accountability, and transparency.

These high standards apply to all, regardless of the size of ownership – even if your dog owns a small part of the company.

Extension of Ethical Standards to Suppliers, Partners, and Stakeholders

Upholding high ethical standards is not limited to just employees – it extends to suppliers, partners, and stakeholders. In this section, we will explore the importance of the code of conduct for legal and regulatory compliance. We will also discuss setting expectations, guiding ethical decision-making, and creating a culture of trust, accountability, and responsible business practices. The ethical foundation of JPMorgan Chase reaches far beyond its employees, encompassing a network of relationships that shape the values and integrity of the organization.

Upholding High Ethical Standards

Text:

JPMorgan Chase’s Code of Conduct provides guidance to employees. It stresses the importance of ethical standards and emphasizes fairness and respect. Discrimination and harassment are not tolerated. Updates to the Code of Conduct are essential for maintaining these standards in an ever-changing business climate. This encourages open communication and enables employees to raise concerns or report potential violations.

Not only employees, but suppliers, partners, and stakeholders must also adhere to these ethical standards. It helps keep the company compliant with legal and regulatory requirements.

At JPMorgan Chase, upholding high ethical standards is critical for gaining trust from employees, clients, and the community. It is imperative to follow the code – any violation of it has serious consequences. By operating ethically and responsibly, the company is on the path to continued growth and success.

Importance of the Code of Conduct for Legal and Regulatory Compliance

JPMorgan Chase emphasizes the importance of a strong and effective Code of Conduct for legal and regulatory compliance. It serves as a guide for ethical behavior and holds employees accountable. The Code sets clear standards for conduct and outlines acceptable behavior to comply with the law. It also helps to manage risk by identifying potential non-compliance.

Training programs and resources are available to support employees in understanding and upholding the Code. These resources educate employees about their rights and responsibilities and equip them with knowledge on navigating legal and regulatory frameworks. This commitment to education fosters a compliant culture within the organization.

It is like teaching a dog to sit, except instead of treats, it’s with the threat of lawsuits and reputational damage.

Setting Expectations and Guiding Ethical Decision-Making

JPMorgan Chase is dedicated to integrity and responsible practices. The Code of Conduct serves as a comprehensive framework, outlining ethical expectations for employees, suppliers, partners, and stakeholders. It sets clear guidelines for behavior and decision-making, creating a culture of trust.

The Code of Conduct covers topics such as conflicts of interest, confidentiality, gifts, bribery, and legal/regulatory compliance. This helps equip employees to make decisions in line with ethical values.

Diversity and inclusion are also emphasized in the ethical standards. JPMC promotes an inclusive environment where everyone is valued and respected. This applies to suppliers, partners, and stakeholders too. Adhering to these standards ensures compliance and builds a culture of equality.

The Code also encourages open communication and reporting. This encourages transparency and provides ways to raise concerns or report violations without fear. Regular reviews and updates keep it relevant and up-to-date.

High ethical standards are essential to maintain trust among employees, partners, stakeholders, and communities. With the Code of Conduct, JPMorgan Chase strives to create a culture of integrity, respect, accountability, and inclusion. Even money needs good manners!

Creating a Culture of Trust, Accountability, and Responsible Business Practices

JPMorgan Chase is committed to promoting integrity, respect, and accountability in all aspects of its operations. Thus, it has established its Code of Conduct to guide employees towards making ethical decisions. This Code of Conduct also applies to suppliers, partners, and other stakeholders.

The company strives to create an inclusive work environment by celebrating differences and having a zero-tolerance policy for discrimination and harassment. It provides resources and support to help employees understand the Code of Conduct and encourages adherence to its principles. Regular reviews and updates are conducted to ensure that the Code of Conduct remains relevant.

Moreover, JPMorgan Chase fosters an environment where individuals feel comfortable to report any violations or concerns related to the Code of Conduct without fear of retaliation. This open communication and reporting mechanism helps to maintain a culture of trust and accountability.

For individuals, adhering to the Code of Conduct and contributing to an ethical work environment can be beneficial for their professional reputation and personal growth within the organization. Enjoy the perks and compensation programs that make you feel like the CEO of your own life at JPMorgan Chase!

Benefits and Services Guide for JPMorgan Chase Employees

Discover the comprehensive Benefits and Services Guide exclusively designed for JPMorgan Chase employees. Explore the detailed information about various benefits and compensation programs, learn how to access the Summary Plan Descriptions, and understand the process of employment verification for former employees. Additionally, gain insights into the limitations surrounding personal or character statements/references. Uncover the invaluable resources and support available to enhance your employee experience at JPMorgan Chase.

Detailed Information about Benefits and Compensation Programs

At JPMorgan Chase, detailed information about their benefits and compensation programs is provided to employees. Below are the various programs available:

- Health Insurance: Medical, dental and vision coverage.

- Retirement Plans: 401(k) plans with company matching.

- Flexible Spending Accounts: Pre-tax dollars for eligible healthcare and dependent care expenses.

- Paid Time Off: Vacation days, holidays and personal leave.

- Bonus and Incentive Programs: Performance-based incentives and bonuses.

- Employee Assistance Programs (EAP): Counseling services and work-life balance programs.

Plus, other perks such as wellness initiatives, tuition assistance and discounted banking services are offered. To utilize these benefits and compensation programs, employees should use the informational resources provided by the company. This can help them make informed decisions tailored to their needs.

Accessing Summary Plan Descriptions

To access Summary Plan Descriptions, take these 4 steps:

- Log in to the JPMorgan Chase intranet with your credentials.

- Go to the HR portal on the homepage.

- Look for the Benefits tab.

- Find and download the Summary Plan Descriptions.

It’s key to access these Descriptions. This way, you can keep up with any changes. Regularly reviewing these Descriptions ensures you understand your benefits package. Also, JPMorgan Chase offers plenty of resources and support for any questions concerning benefits.

In a nutshell, accessing Summary Plan Descriptions is essential. It keeps you informed about your benefits and lets you make informed decisions about your compensation package.

Employment Verification for Former Employees

JPMorgan Chase has employment verification services for ex-employees. They provide a comprehensive process for accuracy and integrity. This includes confirming job dates, titles, and duties. It helps organizations hire better. Additionally, JPMorgan Chase offers help with background checks and references. They offer reliable info to support ex-employees, while keeping confidentiality and following the law.

Use JPMorgan Chase’s services to stay connected even after leaving. Don’t miss chances and make sure your credentials are represented accurately. Trust in their commitment to professionalism and integrity during the process. Think twice before transforming a colleague into a living LinkedIn recommendation.

Limitations on Personal or Character Statements/References

Employees at JPMorgan Chase must abide by limitations on personal or character statements/references. These rules seek to uphold ethical standards.

No personal or character statements about others should be discriminatory, defamatory, or invade privacy rights.

Avoid references to personal attributes or actions, as they can be biased and hurtful.

Statements and references should be supported by facts and objectivity, not personal opinions or estimations.

Workers should take care when discussing others in a professional setting.

Before making public statements or references about someone, get their permission.

Gossiping, rumors, and misinformation about others are not tolerated.

It’s vital for employees to be aware of the rules, to keep a respectful workplace.

Adhering to these restrictions promotes professionalism, respect for privacy, and avoids potential harm.

The Employee Handbook of JPMorgan Chase sets out these restrictions, to protect individuals and uphold professional standards.

Responsibilities of Employees After Employment Ends

In this section, we’ll explore the important responsibilities that JPMorgan Chase employees have after their employment ends. From returning firm assets to maintaining confidentiality and refraining from insider trading, we’ll delve into the various expectations and obligations that former employees must adhere to. Furthermore, we’ll discuss the role of assisting with investigations and litigation, as well as the additional restrictions that senior-level employees need to be aware of. Let’s delve into these post-employment responsibilities in detail.

Returning Firm Assets

At JPMorgan Chase, employees must follow the ethical standards in the Employee Handbook. They must return company-owned items, like laptops, phones, ID badges, and confidential/proprietary info when they leave. Access codes, passwords, and other login credentials must be returned or deactivated. Physical files and documents must go back to their appropriate locations. Any intellectual property should be transferred to the firm. Employees must help with asset audits or reviews.

It is important to return all company assets, as not doing so can lead to legal consequences. By returning items and not sharing confidential info, former employees show respect for their former employer. Check your things and make sure all assets are accounted for. Missing the deadline may lead to legal action and affect future job opportunities. Return the assets on time for a smooth transition. Keep confidential info to yourself!

Maintaining Confidentiality

At JPMorgan Chase, maintaining confidentiality is a must. Employees need to prioritize the protection of sensitive information, and adhere to strict confidentiality principles. This way, they can ensure the safety of important data as well as trust in the organization.

Employees play an essential role in preserving confidentiality. They are responsible for keeping client info, proprietary data, and internal business matters safe. By upholding confidentiality, they help create a culture of trust and honesty.

Moreover, protecting confidential matters also involves refraining from discussing or sharing them outside of work. Employees must not disclose work-related issues to people who don’t have access to such information.

Furthermore, they must properly store confidential documents and materials. This could include locking physical documents in cabinets or using password-protected systems for digital files.

By prioritizing confidentiality, employees protect JPMorgan Chase’s reputation and also ensure compliance with legal and regulatory requirements. Additionally, it shows professionalism and respect for colleagues, clients, and stakeholders.

In the end, maintaining confidentiality is a huge responsibility for JPMorgan Chase employees. It requires exercising discretion and being aware of the risks of disclosing confidential information. Upholding these standards helps create a secure work environment, strengthens client relationships, and promotes ethical business practices.

Remember, always avoid insider trading and make sure your investment strategy is morally sound.

Refraining from Insider Trading

At JPMorgan Chase, we take insider trading very seriously. Our employees are expected to be ethical and hold themselves to the highest standards. Our Employee Handbook outlines the prohibition against insider trading and provides guidelines to ensure compliance with legal and regulatory requirements.

The Code of Conduct emphasizes the importance of professional behavior and avoiding any actions that may damage trust and confidence. It is important for everyone to understand and follow these guidelines in order to protect themselves and the firm.

We also educate our employees about their responsibility to keep information confidential and not misuse it. Through training programs, we help them to identify potential risks related to improper use or disclosure of confidential information.

We offer reporting channels for employees who have concerns or suspect any violations. They can use these whistleblower channels without fear of retaliation. This reinforces our commitment to an ethical and honest culture.

We can look at a real-life example to understand the consequences of insider trading. A former employee shared a confidential merger with a friend, who then used this info to buy shares. The SEC investigated, leading to legal action against both people. This shows the serious legal impact of insider trading.

At JPMorgan Chase, we emphasize the importance of ethical conduct and staying compliant with laws. Through education, clear policies, and reporting channels, we ensure our employees uphold high standards.

Assisting with Investigations and Litigation

Employees at JPMorgan Chase must aid investigations and litigations. This means helping in any active investigations and court matters. While doing this, they need to give any needed information, documents, or testify. They must understand the importance of their role. They should also tell what they know or suspect about any wrongdoings. This keeps a culture of honesty and morality.

Confidentiality is key. Employees must keep secrets regarding investigations and litigations. Even after leaving the job, they must stay confidential about any information they learnt while employed.

By helping with investigations and litigations, employees show that they take ethics seriously. This demonstrates accountability, openness, and faith. In the end, it helps JPMorgan Chase follow regulations and conduct responsible business practices.

Additional Restrictions for Senior-Level Employees

Senior-level employees at JPMorgan Chase are subject to distinct restrictions to maintain ethical behavior and protect the firm’s repute. These aim to uphold high standards of integrity, accountability, and responsible business practices.

Compliance with insider trading regulations is especially crucial for senior-level employees. They are not allowed to use their position or access to secret info for personal benefit or to buy securities.

Senior-level personnel must respect strict confidentiality standards, as they typically have access to sensitive material. This includes protecting proprietary data, client facts, and any other confidential materials.

In addition to returning firm assets upon leaving, senior-level staff must comply with post-employment obligations such as non-compete agreements or non-disclosure agreements. This secures that proprietary info and firm interests are defended even after an employee leaves the organization.

Senior-level employees must comprehend and comply with these additional restrictions for senior-level employees throughout their time at JPMorgan Chase. This displays their dedication to preserving the trust and confidence stakeholders place in the company’s leaders. Not adhering to these restrictions can cause disciplinary action and impair both the individual’s professional reputation and the reputation of JPMorgan Chase as a whole.

As You Leave Guide: Information for Departing Employees

This section provides departing employees with valuable information and guidance as they leave JPMorgan Chase. We will cover key topics such as the guide’s overview and target audience, the range of topics addressed within the guide, and the process for reporting violations of the Code of Conduct. Stay tuned to ensure a smooth and informed transition out of JPMorgan Chase.

Guide Overview and Target Audience

The Guide Overview and Target Audience section is majorly important in the JPMorgan Chase Employee Handbook. It explains the guide’s purpose and who it is for. This includes employees of all levels. It is a great help to new employees joining JPMorgan Chase.

This section gives a clear overview of what they can expect and how it will be useful. It covers topics like company policies, HR procedures, benefits enrollment, IT risk management, and anti-money laundering training. It ensures new employees understand the company’s expectations and what resources are available to them.

The Guide Overview and Target Audience section even has a checklist to help new hires. It explains the company’s structure and employee programs. This makes sure new employees have the knowledge and resources they need to succeed.

So get ready! This guide covers topics to make sure your knowledge is top-notch.

Topics Covered in the Guide

The guide for JPMorgan Chase employees provides comprehensive information on many areas. A table is used to organize the details, with columns such as headings, subheadings, and a brief description of each topic.

Examples of topics covered:

- Ethical standards and expectations

- Commitment to Diversity and Inclusion

- Zero Tolerance Policy for Discrimination and Harassment

- Adherence to the Code of Conduct

- Upholding High Ethical Standards for Suppliers and Stakeholders

- Benefits and Services available to Employees

- Responsibilities after Employment Ends

- Reporting Violations of the Code of Conduct

- Onboarding for New Employees

This is just a fraction of the extensive guide – it covers a wide range of aspects related to working at JPMorgan Chase. Each topic offers valuable information to help employees understand their responsibilities and access resources during their time with the company.

Reporting Violations of the Code of Conduct

At JPMorgan Chase, reporting violations of the Code of Conduct is key. Employees are encouraged to report any misconduct or breaches of ethical standards promptly. Resources and support are available to ensure confidentiality. This builds trust and promotes a culture of ethical behavior.

We regularly review and update the Code of Conduct to deal with emerging issues. This keeps employees informed of their responsibilities and rights. It also helps to manage risks and create an atmosphere of employee wellbeing.

Our zero tolerance policy for discrimination and harassment is paramount. We recognize diversity and inclusion are essential. Reporting violations helps maintain a safe, respectful, and inclusive work environment.

Departing employees must be aware of their obligations. These include returning firm assets and protecting confidential information. Senior-level employees must also assist with investigations and litigation, if needed.

The Code of Conduct serves to protect the interests of JPMorgan Chase. It also upholds industry standards and legal compliance. High ethical standards are demanded from everyone associated with the company. So come join us…and don’t do anything wrong!

Welcome to JPMorgan Chase: Onboarding for New Employees

Welcome to JPMorgan Chase, where we prioritize the seamless onboarding experience for our new employees. In this section, we will familiarize you with the emphasis we place on diversity and growth opportunities, ensure you understand the ins and outs of our company intranet and programs, provide you with a new employee checklist and highlight important milestones. Additionally, we will guide you through benefits enrollment and HR policies, educate you on IT risk management and anti-money laundering training, as well as provide an overview of our company’s structure and corporate groups. Finally, we will introduce you to the wide range of employee programs and services available to support your career journey.

Emphasis on Diversity and Growth Opportunities

JPMorgan Chase puts a strong emphasis on fostering diversity and providing growth opportunities. They see the value of a diverse workforce, believing it leads to innovation and success. To promote an inclusive culture, they attract and retain talented individuals from different backgrounds.

Not only do they recognize the importance of diversity, but they also actively create an environment to support employees’ development and growth. This includes learning and training options, so employees have access to resources to help them succeed.

They extend these values to their network of suppliers, partners, and stakeholders, setting high ethical standards. This reinforces the importance of diversity and growth in the whole business ecosystem.

To further support diversity and growth opportunities, JPMorgan Chase offers a variety of benefits and services. These include info about compensation, employment verification, and limitations on personal statements. They want to make sure their employees have support even after leaving the company.

JPMorgan Chase emphasizes diversity as a key factor for success. They provide ample growth opportunities through training programs, mentorship, and networks. This creates an inclusive work environment that encourages personal development and collective achievement. So, get ready to explore the intranet maze and find programs that will make your head spin (in a good way)!

Familiarization with Company Intranet and Programs

Text:

Familiarizing oneself with the JPMorgan Chase intranet and programs is an essential part of a new employee’s onboarding. The employee handbook stresses the importance of understanding and using these tools properly. Employees should explore the company intranet, which is a hub for info, policies, and resources relevant to their roles. Training programs are also available to equip employees with the skills and knowledge to navigate and use these digital tools.

The employee handbook emphasizes taking advantage of various programs offered by JPMorgan Chase. These programs can help employees grow and develop professionally. From mentorship to leadership initiatives, employees should use these opportunities to build their skills and further their careers. Engaging with company-provided programs can foster a culture of continuous learning, which is valued at JPMorgan Chase.

Employees should stay up-to-date on new features or enhancements implemented within the company intranet. As technology evolves quickly, employees must adapt to changes to maximize productivity and efficiency. Town hall meetings and newsletters are sources of updates about the intranet and associated programs. Staying informed and participating in ongoing training initiatives related to these digital platforms can help employees stay ahead of the curve while collaborating with their teams.

New Employee Checklist and Important Milestones

The heading ‘New Employee Checklist and Important Milestones’ in the JPMorgan Chase Employee Handbook refers to essential tasks and events that new employees must complete/be aware of. It includes procedures to ensure a successful onboarding.

- Diversity and Growth Opportunities:

- Explain the company’s commitment to diversity and equal opportunities for everyone.

- Stress the importance of fostering a diverse and inclusive work environment.

- Company Intranet and Programs:

- Explain the company intranet as a central platform for accessing resources, policies, and communication channels.

- Introduce various programs available to new employees, like training modules and mentorship initiatives.

- Benefits Enrollment and HR Policies:

- Guide new employees through the process of enrolling in benefits.

- Explain HR policies about employee well-being, leave, etc.

- IT Risk Management and Anti-Money Laundering Training:

- Emphasize the significance of IT risk management training for data security.

- Highlight the importance of Anti-Money Laundering (AML) training.

- Overview of JPMorgan Chase Structure and Corporate Groups:

- Provide an overview of the organizational structure at JPMorgan Chase.

- Help new employees understand how their roles fit into the larger framework of the company.

Following this checklist and completing important milestones during the initial period, new employees can familiarize themselves with the company’s policies, programs, and procedures. This will enable them to contribute effectively to the organization.

Benefits Enrollment and HR Policies

The ‘Benefits Enrollment and HR Policies’ section in the JPMorgan Chase Employee Handbook contains info about processes and guidelines for enrolling in benefits and following HR policies. It involves various employee benefits: health insurance, retirement plans, and compensation programs. The section emphasizes the importance of understanding and obeying HR policies to stick to company regulations.

This section stresses the significance of enrolling in JPMorgan Chase’s benefits programs. It explains how these programs help employees with their overall well-being and financial security. It also provides instructions on how to access detailed information about the available benefits.

As well as benefits enrollment, this section covers essential HR policies. These include rules about time off, performance evaluations, and code of conduct. It stresses that it is necessary to obey these policies to make a positive work environment and promote professionalism.

This part of the handbook talks about employees’ responsibility to review and stay informed about changes to HR policies or benefits programs. JPMorgan Chase wants to make sure employees understand ethical standards and can access comprehensive benefits.

It is important for JPMorgan Chase employees to understand and stick to benefits enrollment procedures and HR policies both during and after employment. This includes returning company assets, maintaining confidentiality, avoiding insider trading, and helping with investigations even after employment.

In conclusion, this section in the handbook serves as a guide for employees regarding benefits enrollment and HR policies. It is meant to provide clarity and support for people navigating through their employment journey.

IT Risk Management and Anti-Money Laundering Training

Text:

JPMorgan Chase’s training program has a key focus on robust IT risk management and anti-money laundering. Employees are taught the importance of protecting sensitive data. They learn to spot potential money laundering. They understand their duty to report suspicious activity.

The program has guidance on controls to reduce risks. Advanced analytics tools are used for fraud detection. It includes rules related to anti-money laundering and the consequences of breaking them.

Updates to the program are made regularly. These updates inform employees of changes in laws, risks, and best practices. The aim is to uphold transparency, accountability and regulatory compliance.

After leaving, ex-employees must keep confidential info secret. They must not be involved in insider trading. They may be asked to help with investigations or lawsuits related to their time at the company. Senior-level ex-employees may have further restrictions due to their knowledge of business info. By upholding their responsibilities, ex-employees help maintain JPMorgan Chase’s integrity and reputation.

Overview of JPMorgan Chase Structure and Corporate Groups

Text:

JPMorgan Chase’s Structure and Corporate Groups provide a complete view of the internal framework and its different divisions. Knowing this is essential for people to get around the company efficiently and work with other teams.

JPMorgan Chase is split into various corporate groups, each with its own responsibilities and tasks. Investment banking, commercial banking, asset management, and consumer and community banking are some of these groups. They all have an important role in the organization’s operations and help it succeed.

The structure allows the corporate groups to cooperate and make decisions quickly. It also helps employees understand what each group does to bring value to customers and stakeholders.

Understanding JPMorgan Chase’s structure and its corporate groups gives employees the ability to use internal resources smartly, collaborate with people from different departments, and make meaningful contributions to achieving organizational goals. With an understanding of these corporate groups and how they fit into the company’s bigger framework, employees can make decisions that are in line with JPMorgan Chase’s overall aims.

Unlock a world of privileges and support with JPMorgan Chase’s employee programs and services – it’s like being part of an exclusive club, without the initiation.

Employee Programs and Services

JPMorgan Chase offers many programs to support their employees’ well-being and development. These include the Employee Assistance Program (EAP). This gives access to counseling, mental health resources, and work-life balance programs. With the EAP, employees can get help with any personal or professional issues.

Health and Wellness Programs are also offered. These include fitness challenges, wellness screenings, nutritional guidance, and healthcare resources. This helps promote a healthy lifestyle in employees.

Training and Development Programs are available to help employees improve their skills and knowledge. There are both classroom-based training and online learning resources.

Reward and Recognition Programs are in place to recognize employees’ achievements. Rewards include reaching milestones, exceeding targets, teamwork, or showing leadership skills.

Work-Life Balance Initiatives are also provided, such as flexible work arrangements, parental leave options, childcare assistance programs, and employee resource groups for diversity. This helps employees find balance between work and life.

JPMorgan Chase also has an inclusive culture, valuing diversity, encouraging innovation, collaboration, and ethical behavior. With all these programs, they want to create a positive and fulfilling work environment. This will benefit both the employees and the company.

Conclusion

The JPMorgan Chase employee handbook is a comprehensive guide for employees. It outlines policies, procedures, and expectations within the organization. Additionally, it covers employee conduct, benefits, a code of ethics, and disciplinary actions.

This handbook allows employees to understand their rights and responsibilities as well as the company’s commitment to diversity and inclusion. It also emphasizes the importance of maintaining a respectful and professional workplace.

Furthermore, the handbook includes information on topics such as performance evaluations, career development, and employee benefits. It provides employees with the necessary details to understand how their performance will be assessed and the opportunities available for growth and advancement.

Some Facts About JPMorgan Chase Employee Handbook Example:

- ✅ JPMorgan Chase has a Code of Conduct that outlines the company’s ethical standards and expectations for employees. (Source: Team Research)

- ✅ The Code of Conduct emphasizes the importance of integrity, respect, and accountability in all aspects of the business. (Source: Team Research)

- ✅ The Code of Conduct covers topics such as conflicts of interest, confidentiality, compliance with laws and regulations, and the use of company resources. (Source: Team Research)

- ✅ JPMorgan Chase has a zero tolerance policy for discrimination and harassment. (Source: Team Research)

- ✅ The Code of Conduct is regularly reviewed and updated to ensure its continued relevance and effectiveness. (Source: Team Research)

FAQs about Jpmorgan Chase Employee Handbook Example

FAQ 1: What does the JPMorgan Chase Employee Handbook offer to new employees?

Answer: The JPMorgan Chase Employee Handbook provides important information, such as the Code of Conduct affirmation, drug testing, online forms, obtaining an ID badge, job-specific training, and familiarizing oneself with the work area. It also covers topics like emergency procedures, time reporting, and department policies.

FAQ 2: Can I request a paper copy of the JPMorgan Chase benefits program summary plan descriptions (SPDs)?

Answer: Yes, you can request a paper copy of the benefits program summary plan descriptions (SPDs) by calling the accessHR Contact Center.

FAQ 3: How can former JPMorgan Chase employees verify their employment?

Answer: Former employees can use the Employment Verification Hotline to verify basic employment information such as employment status, dates, and job title. However, salary information can only be accessed with an authorization code obtained through the accessHR Contact Center.

FAQ 4: Does JPMorgan Chase provide personal or character statements as references?

Answer: No, JPMorgan Chase does not provide personal or character statements/references, including performance information, reasons for termination, rehire status, or probability of continued employment.

FAQ 5: What is the eligibility criterion for the JPMorgan Chase U.S. Benefits Program?

Answer: The JPMorgan Chase U.S. Benefits Program is available to most employees on a U.S. payroll who work at least 20 hours a week.

FAQ 6: What responsibilities do employees have after employment ends according to the JPMorgan Chase Code of Conduct?

Answer: After employment ends, employees are responsible for returning firm assets, maintaining confidentiality, refraining from insider trading, and assisting with investigations and litigation if requested. Senior-level employees have additional restrictions on soliciting customers or hiring employees.

Important Disclaimer:

The article presented here does not serve as a representation of the company’s actual employee handbook mentioned in this article.

Our discussions and insights regarding employee handbook are based on assumptions about what may be considered significant in this companies’ policies. These assumptions are drawn from available information and industry knowledge. Readers are advised that the content provided is for informational purposes only and should not be construed as an exact reflection of any company’s official policies or procedures. For precise and accurate details regarding a company’s employee handbook, individuals should refer directly to the company’s official documentation or consult with appropriate representatives.

Please be aware that the content on this page has been generated by using artificial intelligence language models and may contain errors, inconsistencies, or outdated information. It is provided as-is without any warranties or guarantees of accuracy. We strongly recommend using this content as a starting point for further research. We disclaim any liability for damages or losses resulting from the use or reliance on this content.