Welcome to the world of Fidelity National Information Services (FIS)! With a comprehensive employee handbook that covers everything from company policies to retirement planning, FIS ensures that its employees have all the tools and information they need to succeed. Let’s dive into the key components of the FIS Employee Handbook and discover how it supports employees in achieving their personal and professional goals, using a “fidelity national information services employee handbook example”.

Key Takeaways

- FIS Employee Handbook provides comprehensive information on policies, procedures, and benefits.

- Employees are supported with retirement planning resources as well as health insurance and wellness programs.

- FIS is committed to upholding ethical standards by providing guidance on conflict of interest resolution and data protection protocols for employees.

Fortune 100 Company Employee Handbook

Welcome to our esteemed Fortune 100 Company, where our commitment to excellence extends to every aspect of our operations, including our employee handbook. The Fortune 100 Company Employee Handbook serves as a comprehensive guide to navigating the dynamic and innovative workplace culture that defines our organization. Within these pages, you’ll find valuable information on company policies, benefits, and the shared values that drive our success. As an integral part of our team, familiarizing yourself with the guidelines outlined in the Fortune 100 Company Employee Handbook is essential for fostering a collaborative and thriving work environment. Embrace the principles and standards articulated in this handbook, and together, let’s continue to elevate our company to new heights of achievement.

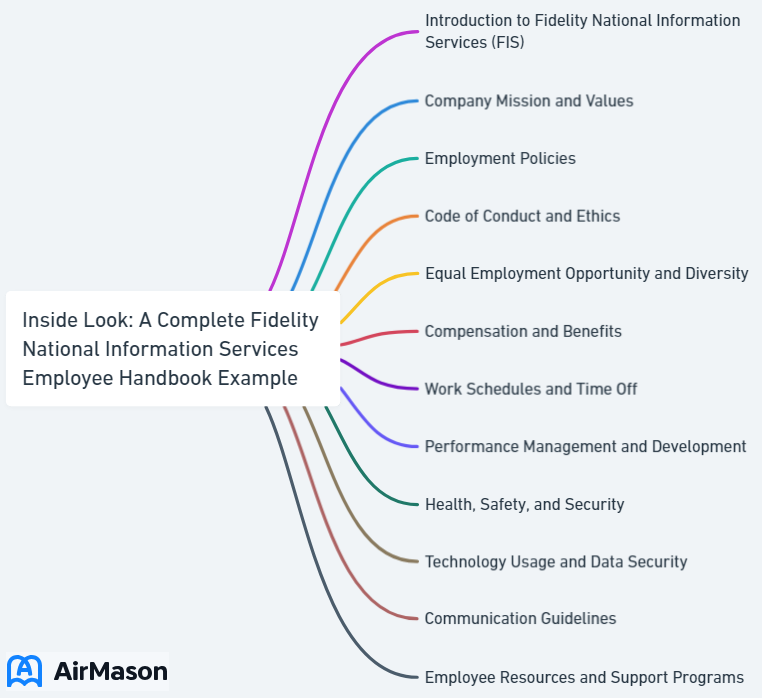

Fidelity National Information Services (FIS) Employee Handbook Overview

The FIS Employee Handbook is a comprehensive guide, providing employees with necessary information on:

- company policies

- procedures

- benefits

- expectations

By providing insights into the organization’s culture, values, and guidelines for behavior, the handbook assists employees in navigating their careers with FIS and achieving long-term success. One unique feature of the FIS Employee Handbook is its emphasis on retirement planning, ensuring that employees are well-equipped to secure their financial future.

Beyond company policies and benefits, the FIS Employee Handbook covers ethical conduct and core values. These sections are designed to instill a strong sense of integrity and responsibility among employees, fostering an environment of trust and collaboration.

Purpose of the FIS Employee Handbook

The FIS Employee Handbook was designed to guide employees through the company’s values, policies, procedures, and other significant matters relating to their employment, including opportunities for tax-deferred growth. Since its inception in 1968, the handbook has evolved and adapted to the growth and acquisitions of FIS, ensuring that it remains relevant to employees’ financial future.

FIS colleagues are expected to:

- Read and comprehend the Employee Handbook and use it as a reference for company policies and procedures, including financial planning.

- Access the handbook on the company’s intranet site FIS & me.

- Access information about tax benefits and other financial planning resources on FIS & me.

Key Sections of the Handbook

The FIS Employee Handbook is divided into several key sections, covering a range of topics such as employee benefits, ethical culture and core values, and retirement planning. Some noteworthy sections include Basic Employee Life Insurance and Accidental Death & Dismemberment (AD&D) Insurance, Employee Assistance Programs, and the Code of Business Conduct.

The FIS Employee Handbook serves as a comprehensive guide for employees, encompassing:

- Corporate regulations

- Advantages

- Moral values

- Retirement account planning

The retirement planning handbook also guides employees on collaborating with financial advisors, guaranteeing that they have access to expert advice and support for their retirement planning needs within a retirement group.

Comprehensive Employee Benefits at FIS

FIS provides an extensive array of employee benefits to bolster its workforce. These benefits include:

- Health insurance

- Wellness programs

- Retirement plans

- Work-life balance initiatives

By providing such a diverse range of benefits, FIS aims to ensure the well-being, satisfaction, and long-term success of its employees.

Along with these benefits, FIS offers advice on managing unsecured debt, aiding employees in maintaining financial stability during their working years and into retirement. By offering comprehensive benefits and financial guidance, FIS demonstrates its commitment to the well-being and success of its employees.

Health Insurance and Wellness Programs

FIS acknowledges the significance of preserving the health and well-being of its employees by offering a variety of health insurance options to help manage healthcare expenses. These options include:

- Medical insurance

- Dental insurance

- Vision insurance

- Supplemental employee and dependent life insurance

- Short and long-term disability coverage

To support employee well-being, FIS also provides a range of wellness programs. These programs include Employee Wellbeing With One FIS, health coaching for chronic conditions, and financial wellness programs. Through these initiatives, FIS fosters a healthy and engaged workforce, ensuring that employees have the resources and support they need to thrive both personally and professionally.

Retirement Plans and Investment Options

Retirement planning is a vital component of financial well-being and FIS is dedicated to equipping its employees with an array of retirement solutions and services. While specific details regarding the retirement plans and investment options offered to FIS employees are not publicly available, the company does provide the following retirement services:

- Retirement plan outsourcing

- Recordkeeping and plan administration

- Retirement plan compliance solutions

- Retirement education solutions

- Trust and custody services for retirement

To be eligible for participating in Fidelity National Information Services (FIS) retirement plans, employees must have attained age 18 and have completed 90 days of service. This allows employees to start planning for their retirement early, ensuring that they have ample time to build their retirement savings.

At Fidelity National Information Services (FIS), the retirement matching contribution policy entails the employer matching a percentage of the employee’s contributions to the plan. The exact details of the matching contribution, such as the percentage and dollar-for-dollar matching, may differ based on the plan and individual circumstances. By offering employer matching contributions, FIS helps its employees maximize their retirement savings and achieve their long-term financial goals.

Work-Life Balance Initiatives

Promoting work-life balance is an essential aspect of employee well-being, and FIS has implemented several initiatives to support this goal. These initiatives include:

- Fostering a sense of belonging

- Emphasizing wellness

- Providing flexible work arrangements

- Organizing employee engagement events

- Offering programs for physical and mental health

By creating an environment where employees can achieve balance in their personal and professional lives, FIS contributes to the overall satisfaction and long-term success of its workforce.

One notable aspect of FIS’s work-life balance initiatives is its flexible work arrangements. The company provides employees with a range of options in terms of working hours, project selection, and team composition, allowing individuals to tailor their work environment to their unique needs and preferences. This flexibility not only contributes to employee satisfaction but also enables FIS to attract and retain top talent in the competitive financial services industry.

Jackson Financial Employee Handbook Example

Welcome to the Jackson Financial Employee Handbook Example. This comprehensive guide outlines our company’s policies and procedures to ensure a harmonious and productive work environment. In the following pages, you will find detailed information on topics such as workplace conduct, benefits, and professional development opportunities. The Jackson Financial Employee Handbook Example is designed to be a valuable resource for both new and existing team members, offering insights into our organizational culture and expectations. We encourage you to familiarize yourself with the contents of this handbook to promote a positive and collaborative workplace experience. If you have any questions or concerns, please don’t hesitate to reach out to the Human Resources department.

FIS Code of Conduct: Ethical Standards and Expectations

The FIS Code of Conduct sets forth the ethical standards and expectations for employees, emphasizing the company’s core values and guidelines for ethical behavior. By outlining these standards, the Code of Conduct provides a framework for decision-making and behavior, helping to create a culture of trust, integrity, and accountability within the organization.

In addition to outlining ethical standards, the FIS Code of Conduct also details reporting procedures for potential violations. This ensures that any concerns or issues can be promptly addressed, maintaining the integrity of the company and its commitment to ethical conduct.

Core Values and Principles

FIS upholds a set of core values and principles that serve as the foundation for ethical conduct and decision-making within the company. These values include:

- One FIS Culture

- Innovation

- Customer-Oriented

- Responsibility and Ownership

- Openness and Fairness

These values guide employees in their interactions with clients, colleagues, and the community.

By fostering a culture that is rooted in these core values and principles, FIS promotes an environment of trust, collaboration, and ethical behavior. Employees are encouraged to adhere to these values in their daily work, ensuring that the company maintains its reputation for integrity and excellence in the financial services industry.

Guidelines for Ethical Behavior

At FIS, ethical behavior is of the utmost importance. The company expects its employees to set the highest standards when it comes to honesty and integrity. They are also required to abide by all applicable laws and internal policies. FIS insists that all colleagues, clients, and consumers should be given equitable and respectful treatment. We firmly believe they should be treated with respect and dignity..

In addition to these standards, the FIS Code of Conduct also outlines guidelines for the appropriate use of gifts and entertainment in a business context. Employees are expected to ensure that such exchanges do not improperly influence business decisions or create conflicts of interest.

Reporting Misconduct and Compliance Procedures

FIS takes the reporting of potential misconduct seriously and has established channels for employees to report any concerns or issues they may encounter. If a manager is made aware of a potential violation of the Code of Conduct, they must report it promptly to the Ethics Office at fisethicsoffice@fisglobal.com or to the Company’s Ethics Helpline.

Employees may report misconduct by:

- Bringing the matter to the attention of their manager

- Reporting it to the Ethics Office at fisethicsoffice@fisglobal.com

- Calling the Ethics Helpline

- Submitting the concern through the website at www.fnisethics.com

FIS encourages a culture of transparency and accountability, ensuring that any concerns are addressed promptly and effectively.

Failure to abide by the Code of Conduct or comply with its provisions may lead to disciplinary measures, including dismissal, in accordance with applicable legislation. By enforcing these measures, FIS maintains the integrity of the company and its commitment to ethical conduct.

Retirement Planning for FIS Employees

Planning for retirement is an essential aspect of financial well-being, and FIS is committed to providing its employees with the necessary tools and resources to achieve their retirement goals. Through the FIS Employee Handbook, employees can access guidance on setting personal retirement goals, budgeting for retirement, and establishing strategies for stretching their retirement funds over time.

By offering comprehensive retirement planning resources, FIS enables its employees to build a solid foundation for their financial future. This includes:

- Retirement savings plans

- Investment options

- Financial education and guidance

- Access to retirement calculators and tools

This not only ensures long-term financial stability but also contributes to the overall well-being and satisfaction of the workforce.

Setting Personal Retirement Goals

Setting personal retirement goals is an important step towards attaining financial security and well-being in one’s later years. By setting clear objectives and developing a plan to achieve them, employees can maintain control over their financial future and ensure that they are well-prepared for retirement through options such as individual retirement accounts.

Employees in the financial services industry may have a variety of personal retirement goals, such as:

- Building a substantial retirement savings portfolio

- Maintaining or improving their financial circumstances during retirement

- Increasing wealth and financial security

- Planning for milestone events or activities during retirement

- Prioritizing wellness and maintaining a healthy lifestyle

- Discovering new interests and hobbies

- Re-thinking residences and considering relocation options

- Leaving a legacy or providing for future generations

- Taking advantage of employer matches and financial advice or guidance

- Implementing a retirement plan and accumulating wealth throughout their career.

FIS provides a range of retirement solutions and services to assist employees in setting and achieving their personal retirement goals. These include:

- Retirement plan outsourcing

- Recordkeeping and plan administration

- Retirement plan compliance solutions

- Retirement education solutions

- Trust and custody services for retirement

By offering these resources, FIS empowers its employees to take control of their retirement planning and achieve their desired financial outcomes.

Retirement Budgeting and Savings Strategies

Budgeting for retirement is imperative to attain individual retirement goals and guarantee future financial security. By developing a comprehensive retirement budget and implementing effective savings strategies, employees can maximize their retirement savings and manage their monthly expenses, ensuring a comfortable life in their golden years.

FIS provides its employees with a range of programs and resources to assist with retirement budgeting. These include retirement planning tools and calculators, educational materials and workshops, as well as retirement savings plans with employer matching contributions. By offering these resources, FIS enables its employees to develop a solid retirement budget and implement effective savings strategies, ensuring long-term financial stability and well-being.

Stretching Retirement Funds Over Time

Making sure that retirement funds last throughout one’s retirement years is a significant aspect of financial planning. By implementing strategic planning and investment strategies, such as asset allocation, employees can stretch their retirement funds over time, ensuring that they have the financial resources necessary to enjoy a comfortable retirement.

Recommended strategies for stretching retirement funds include:

- Withdrawing money at a conservative rate

- Dividing funds into ‘buckets’

- Adhering to the 4% rule

- Maximizing retirement accounts

- Minimizing basic expenses

- Reducing overall expenses

- Using the Social Security estimate calculator

- Making catch-up contributions

- Considering delaying Social Security

- Implementing dollar cost averaging

By implementing these strategies, employees can optimize their retirement savings and ensure that their funds last throughout their retirement years.

Diversification is another essential factor in extending retirement funds over time. By investing in a range of assets and companies, employees can create a diversified portfolio that helps protect their capital and maximize risk-adjusted returns. Additionally, tax advantages can also aid in extending retirement savings by offering flexibility in terms of withdrawals and tax implications.

Navigating Conflicts of Interest at FIS

Conflicts of interest can occur in any organization, including FIS. The company has a policy in place for recognizing and addressing potential conflicts of interest or duty, applicable to all FIS legal entities and affiliates. By having a comprehensive policy and procedures in place, FIS ensures that potential conflicts are identified and managed effectively, maintaining the integrity of the company and its commitment to ethical conduct.

Potential conflicts of interest that may arise at FIS include:

- Conflicts between personal interests and the interests of the company or its clients

- Conflicts between employees’ personal relationships and their professional responsibilities

- Conflicts related to financial transactions or investments

In order to manage these conflicts effectively, FIS has established procedures for identifying and addressing potential conflicts of interest or duty.

Recognizing Potential Conflicts

Identifying potential conflicts of interest is a significant part of upholding ethical conduct within an organization. Employees at FIS are encouraged to remain mindful of their personal interests and activities outside of work and to adhere to the FIS Code of Business Conduct and Ethics. By doing so, they can identify potential conflicts of interest and avoid situations that may compromise their objectivity and integrity.

Some common forms of conflicts of interest at FIS include:

- Overlapping professional and private interests

- Personal investments or secondary business activities conflicting with company objectives

- Hiring or promoting unqualified relatives

- Initiating a company that provides services similar to those of FIS

- Financial interests that could potentially influence decision-making

By identifying and addressing these conflicts, FIS can maintain its commitment to ethical conduct and ensure that decisions are made in the best interest of the company and its clients.

Disclosure and Resolution Procedures

FIS has implemented procedures for disclosing and resolving conflicts of interest to uphold ethical conduct within the organization. Employees are required to:

- Inform their supervisor or the Human Resources department of any actual or potential conflicts of interest.

- Follow the procedures outlined in the FIS Conflict of Interest Policy for resolving conflicts of interest.

- Review disclosure forms and implement corrective action if necessary.

In addition to the internal reporting procedures, FIS has also established a Conflicts of Interest Registry to facilitate the disclosure and resolution of potential conflicts. Employees can submit potential conflicts of interest to the registry for review and approval by the Ethics Office. This ensures that any conflicts are addressed promptly and effectively, maintaining the integrity of the company and its commitment to ethical conduct.

The FIS Ethics Office plays a critical role in reviewing and resolving conflicts of interest submitted through the registry. By thoroughly investigating each submission and implementing appropriate corrective actions, the Ethics Office ensures that FIS maintains its commitment to ethical conduct and upholds the company’s core values.

Data Protection and Confidentiality at FIS

Data protection and confidentiality hold paramount importance in our growing digital world. FIS is dedicated to safeguarding the privacy and security of personal information that it processes to deliver services. The company has established policies and procedures to ensure the protection of personal and client data, demonstrating its commitment to data security and privacy.

Along with data protection policies, FIS also implements measures to ensure adherence to applicable data protection and privacy laws. By adhering to these regulations, FIS maintains the trust of its clients and employees and ensures the secure handling of sensitive information.

Protecting Personal and Client Data

FIS is dedicated to safeguarding personal and client data in line with its policies and relevant laws. The company has implemented a range of security measures, including physical, electronic, and procedural safeguards, to ensure the protection of sensitive information.

In addition to its security measures, FIS also adheres to a Privacy Policy that regulates the management of personal data. By following this policy, FIS demonstrates its commitment to data protection and ensures that personal information is handled in a secure and responsible manner.

Berry Global Group Employee Handbook Example

In this illustrative Berry Global Group Employee Handbook Example, we delve into the comprehensive guidelines and policies that govern our workforce. The Berry Global Group Employee Handbook serves as a crucial document outlining our commitment to fostering a positive and inclusive workplace environment. Through this example, employees gain insights into the company’s values, code of conduct, and expectations, ensuring a harmonious and productive professional experience. It provides a roadmap for navigating various aspects of employment, promoting a shared understanding of responsibilities and rights. As you explore this handbook, you’ll find a wealth of information designed to empower our workforce and uphold the standards that define the Berry Global Group community.

Employee Responsibilities for Data Protection

FIS employees play a significant role in protecting data and upholding confidentiality in all aspects of their work. They are expected to adhere to all privacy and security protocols, ensuring that personal information is protected from unauthorized access or intrusion.

To support employees in fulfilling their data protection responsibilities, FIS provides annual training on privacy and security protocols. This training ensures that employees are well-equipped to handle sensitive information and maintain the highest standards of data protection within the organization.

Summary

In conclusion, the FIS Employee Handbook provides a comprehensive guide for employees, covering a wide range of topics such as company policies, employee benefits, ethical standards, and retirement planning. By offering this valuable resource, FIS empowers its employees to achieve personal and professional success while maintaining the highest standards of ethical conduct and data protection. With a strong commitment to employee well-being and a focus on ethical behavior, FIS sets an example for other companies in the financial services industry.

Frequently Asked Questions

What does Fidelity National Information Services do?

Fidelity National Information Services Inc. provides a range of technology solutions for banking, payments, asset and wealth management, risk and compliance, payment processing, consulting, and outsourcing.

What is the code of conduct for FIS?

The FIS code of conduct requires members to conduct business in a manner that reflects credit on the Association, adopt and commit to the principles and practices laid down by FIS, and act with integrity towards others while exercising high standards of business practice and workmanship.

What is the FNF Code of Business Conduct and Ethics?

FNF is committed to upholding the highest legal and ethical standards in all aspects of our business, and our Code of Business Conduct and Ethics provides guidance, support, and resources to ensure that we conduct ourselves ethically and in compliance with applicable laws.

How many employees does Fidelity National Information Services have?

Fidelity National Information Services currently employs 69,000 people, which marks a 6.15% increase from 2021.

What is the purpose of the FIS Employee Handbook?

The FIS Employee Handbook provides comprehensive information on company policies, procedures, benefits, and expectations to help employees understand their rights and responsibilities, as well as plan for retirement.

Important Disclaimer:

The article presented here does not serve as a representation of the company’s actual employee handbook mentioned in this article.

Our discussions and insights regarding employee handbook are based on assumptions about what may be considered significant in the companies’ policies. These assumptions are drawn from available information and industry knowledge. Readers are advised that the content provided is for informational purposes only and should not be construed as an exact reflection of any company’s official policies or procedures. For precise and accurate details regarding a company’s employee handbook, individuals should refer directly to the company’s official documentation or consult with appropriate representatives.

Please be aware that the content on this page has been generated by using artificial intelligence language models and may contain errors, inconsistencies, or outdated information. It is provided as-is without any warranties or guarantees of accuracy. We strongly recommend using this content as a starting point for further research. We disclaim any liability for damages or losses resulting from the use or reliance on this content.