Are you trying to comprehend the DCP Midstream employee handbook? This “dcp midstream employee handbook example” outlines the crucial policies on benefits, employment terms, and termination processes. As a worker or a prospect at DCP Midstream, you’ll find what you need to know about your rights and entitlements in our direct breakdown of the handbook.

Key Takeaways

- DCP Midstream provides competitive health benefits and fosters a supportive employer-employee relationship, offering dental, vision, life insurance, 401(k) matches, and paid time off, among other benefits.

- Terminated employees of DCP Midstream are entitled to severance pay and may opt for COBRA coverage, which they are responsible for funding up to 102% of the cost, and may last for the maximum COBRA period of eighteen months.

- DCP Midstream’s employee handbook outlines legal aspects of employment termination including adherence to the FMLA, the process for legal suits in federal court, and offers outplacement assistance programs to help former employees transition to new careers.

Fortune 100 Company Employee Handbook

Welcome to the comprehensive guide that outlines the policies, expectations, and benefits encapsulated in our Fortune 100 Company Employee Handbook. This essential resource serves as a compass for all employees, providing insights into the values that drive our organization and the standards that shape our work culture. As you embark on your journey with us, familiarize yourself with the contents herein, ensuring a harmonious and successful collaboration. From code of conduct to employee benefits, this handbook is designed to empower you with the knowledge necessary to thrive within our esteemed Fortune 100 company.

Understanding DCP Midstream’s Group Health Plan

Health benefits form a substantial component of an employment package, and DCP Midstream’s group health plan perfectly exemplifies this. Employees receive group health insurance, which is competitive within the energy sector, and offers a broad range of benefits, including dental insurance, paid time off, and holidays during the course of employment.

Employer Employee Relationship

DCP Midstream nurtures an employer-employee relationship that transcends contractual obligations, extending into their group health plan. The company’s health plan benefits include:

- 401K plan

- Paid time off

- Dental insurance

- Paid holidays

These benefits are designed to promote employee happiness, loyalty, and productivity during an employee’s employment, with such agreement in place to ensure a positive work environment.

Additionally, this relationship shapes the provisions of the company’s health plan. For instance, workers’ compensation and employer’s liability insurance are maintained during the period of secondment, and the plan is only applicable to employees who are involuntarily terminated or whose employment is terminated, up to the maximum COBRA period.

Coverage Options

DCP Midstream’s employer’s group health plan, known for its diverse portfolio, offers an array of coverage options to employees, including group health insurance. One of the unique aspects of the company’s health plan includes options for family coverage, which extends to an employee’s spouse, even if the spouse has access to a spouse’s employer plan.

In addition, what sets DCP Midstream’s group health plan apart in the industry are its comprehensive medical plan options, dental, vision, and life insurance, disability coverage, and legal insurance. The company also offers 401(k) savings matches and retirement contributions, along with various leave options, all available during the course of an employee’s employment.

Navigating Employment Termination and Benefits

The possibility of employment termination, or her employment in particular, is a reality that all employees might confront eventually. Understanding the benefits and policies surrounding this scenario is crucial, especially in a company like DCP Midstream, which has recently undergone a workforce reduction due to its reorganization.

Severance Pay and Incentive Pay

A cornerstone of DCP Midstream’s termination benefits is its severance pay policy. An Executive Committee member at DCP Midstream is entitled to Severance Pay equivalent to one (1) times Base Pay. This pay is determined by considering various factors, including the employee’s role, tenure, and other complicated and difficult issues.

Additionally, DCP Midstream offers incentive pay to its workforce, inclusive of Executive Committee members eligible for severance pay. The level of incentive pay at DCP Midstream is influenced by:

- the distribution of compensation across base salary

- short-term incentives

- long-term incentives

- Fair Market Value

- recent arm’s length transactions, primarily for Named Executive Officers (NEOs).

COBRA Coverage

Health coverage after termination is a significant concern for numerous employees. DCP Midstream addresses this concern by providing subsidized COBRA coverage to eligible severance employees. To qualify, employees must select COBRA coverage and fulfill the required COBRA eligibility criteria.

The COBRA coverage for terminated employees of DCP Midstream usually lasts for the applicable maximum COBRA period of eighteen months, or until the individual becomes covered under another group health plan. It’s worth noting that terminated employees are accountable for the complete expense of COBRA coverage, which may amount to as much as 102% of the cost of the medical coverage plan.

Legal Aspects of Employment Termination

Termination of employment transcends company policy, venturing into legal implications. This section delves into the legal aspects such as the Medical Leave Act and potential legal suits, which play a crucial role in determining the employee’s termination date and process.

Medical Leave Act

The Medical Leave Act, also known as the Family and Medical Leave Act (FMLA), is an essential legal aspect that impacts employment termination. In essence, the Act allows eligible employees to take up to 12 weeks of unpaid, job-protected leave for specific family and medical reasons per year.

At DCP Midstream, employees are entitled to take a maximum of 12 weeks of unpaid leave for the birth and care of a new child, in accordance with the FMLA. The company ensures adherence to the Act by offering this leave and requiring employees to adhere to all relevant laws, regulations, and rules.

Legal Suit and Federal Courts

Legal suits and federal court involvement can significantly shape the course of employment termination. Federal courts handle issues related to discrimination, harassment, and retaliation. The Supreme Court, in particular, has had a substantial influence on the interpretation and resolution of these cases, as such court plays a crucial role in setting precedents.

The procedure for a legal suit related to job termination in a federal court usually involves:

- Initiating the process with evidence collection of wrongful termination

- Securing the services of an employment attorney

- Submitting a civil complaint

- Serving notice to the previous employer

- Subsequently pursuing the lawsuit in federal court.

An employee seeking to initiate a wrongful termination lawsuit in federal court should commence by submitting a charge of discrimination to the Equal Employment Opportunity Commission (EEOC).

Outplacement Services and Assistance

Upon employment termination, DCP Midstream extends outplacement services and assistance. These services aim at supporting the terminated employees through the transition period and easing their path to a new career.

Outplacement Assistance Programs

DCP Midstream’s outplacement assistance programs are designed to aid terminated employees in transitioning to new careers. These programs, included in a severance package, offer the following benefits:

- Enhance employee retention

- Increase productivity

- Reduce litigation risks

- Improve the employer’s brand and reputation.

The company’s outplacement assistance programs are structured as a component program under the DCP Midstream, LP Welfare Plan. The company also offers subsidized COBRA benefits as part of its outplacement assistance through the Executive Severance Plan.

Qualifying Layoff Criteria

To avail of the outplacement services, employees must meet certain criteria. At DCP Midstream, employees become eligible for outplacement assistance through the DCP Midstream, LP Executive Severance Plan, which mandates adherence to the following payment conditions for eligibility:

- Must be a current employee of DCP Midstream

- Must be eligible for severance benefits as outlined in the Executive Severance Plan

- Must meet any additional criteria specified by the company

However, it’s worth noting that DCP Midstream does not specify the qualifying layoff criteria for outplacement services in cases of voluntary termination. For involuntary termination, only employees who are terminated through no fault of their own, or are terminated involuntarily, are eligible for the Plan.

Tax Implications of Employment Termination

The financial dimensions of employment termination go beyond severance pay and outplacement services. It’s also crucial to understand the tax implications that follow termination.

Applicable Taxes on Severance Pay

Severance pay, a common part of termination benefits, is subject to taxation. In other words, severance pay is considered taxable income and should be reported as regular wages on a tax return form.

After Tax Basis Benefits

After-tax basis benefits are another significant aspect of the financial implications of employment termination. These benefits are determined by comparing the net after-tax returns on taxable and tax-exempt bonds to ascertain which investment provides a higher yield post-taxes, taking into account applicable tax withholding and less applicable taxes. It is essential to consider the termination date when evaluating these financial implications.

Receiving benefits on an after-tax basis following termination of employment suggests that any benefits received would be taxable if the premiums for these benefits were not initially included in the employee’s income. However, opting to pay premiums on an after-tax basis can help in avoiding immediate taxation on the benefits received.

Additional Information and Resources

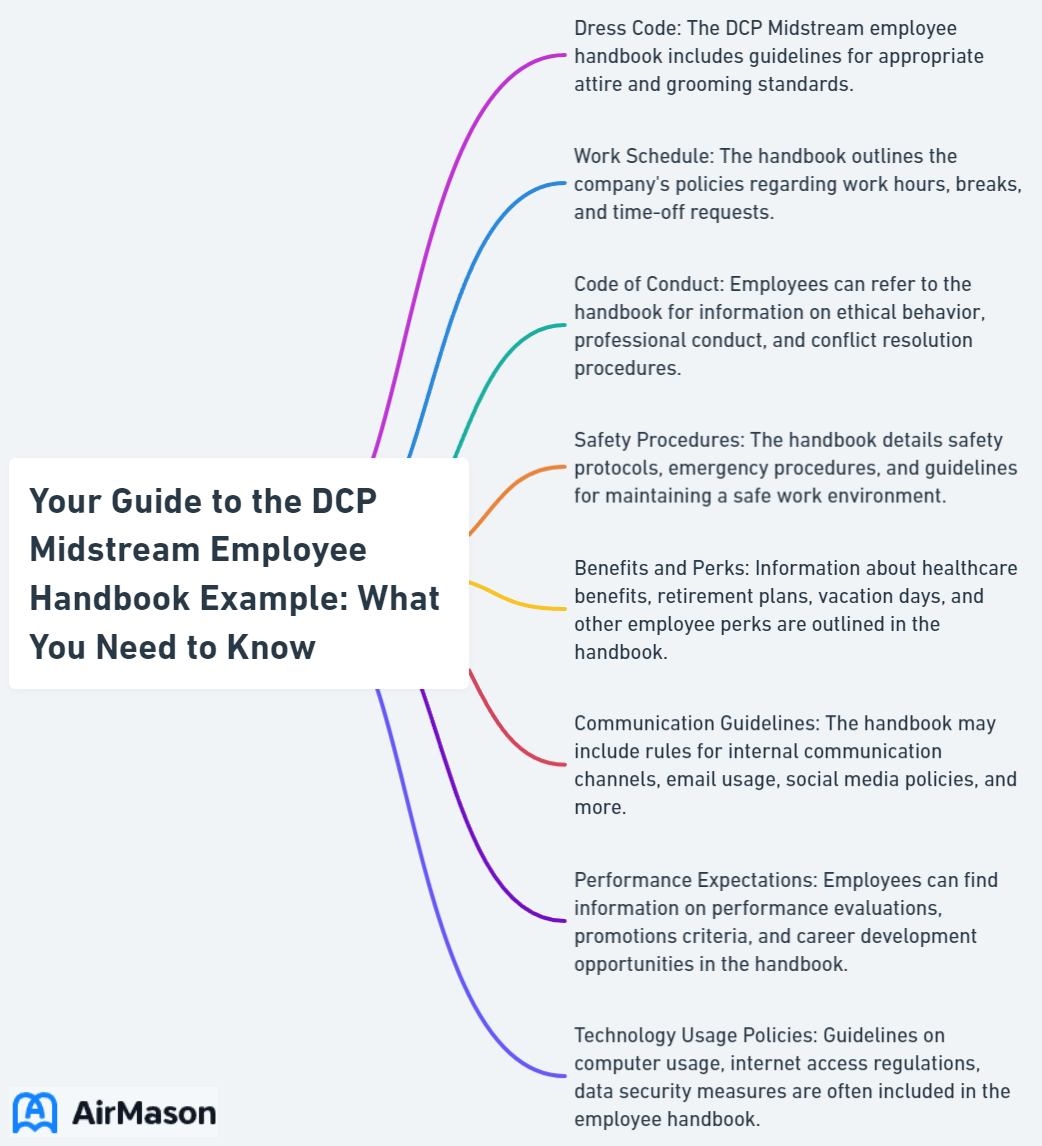

Apart from health plans, termination benefits, and legal aspects, DCP Midstream’s employee handbook presents a plethora of additional information and resources, potentially beneficial for employees.

Company Policies and Procedures

DCP Midstream operates on a set of guiding principles that inform its company policies. These policies are designed to safeguard employees from retaliation when reporting potential unethical behavior and place a high priority on pipeline integrity through the implementation of diverse monitoring and risk analysis methods.

To ensure compliance, the company mandates strict adherence to these policies and procedures, particularly when engaging in contractual agreements to the maximum extent permitted. DCP Midstream also prioritizes transparent and open communications and guarantees protection for employees who raise grievances in good faith.

Employee Support Services

DCP Midstream’s support services extend into various areas, providing resources for both personal and professional development of its employees. Some of these services include:

- Company-sponsored wellness program

- Tuition assistance

- Flexible spending account

- Employee assistance programs

- Health savings accounts

These services contribute significantly to the personal and professional development of its employees.

Moreover, the company’s support services also encompass counseling and mental health services, further underscoring DCP Midstream’s commitment to employee well-being.

Summary

Navigating through the complexities of an employee handbook, especially that of a multifaceted company like DCP Midstream, can be a daunting task. However, with a deeper understanding of the group health plan, employment termination benefits, legal aspects, outplacement services, tax implications, and additional resources, you’re now better equipped to navigate through DCP Midstream’s employee handbook.

Frequently Asked Questions

What is the importance of understanding the employer-employee relationship at DCP Midstream?

Understanding the employer-employee relationship at DCP Midstream is important because it affects the company’s group health plan and impacts employee happiness, loyalty, and productivity.

What are the key aspects of DCP Midstream’s termination benefits?

The key aspects of DCP Midstream’s termination benefits are severance pay, incentive pay, and COBRA coverage. These benefits aim to provide support for employees during the transition period.

How does the Medical Leave Act impact employment termination at DCP Midstream?

The Medical Leave Act allows eligible employees to take up to 12 weeks of unpaid, job-protected leave for specific family and medical reasons per year, potentially impacting employment termination at DCP Midstream.

What are the tax implications of employment termination?

After employment termination, individuals may face tax obligations on various forms of compensation, such as severance pay and accrued leave. It’s important to understand the tax implications of these payments to avoid any surprises.

What additional resources does DCP Midstream provide to its employees?

DCP Midstream offers a variety of additional resources to its employees, such as a wellness program, tuition assistance, flexible spending accounts, employee assistance programs, and health savings accounts. These additional resources contribute to the well-being and support of the employees.

Important Disclaimer:

The article presented here does not serve as a representation of the company’s actual employee handbook mentioned in this article.

Our discussions and insights regarding employee handbook are based on assumptions about what may be considered significant in the companies’ policies. These assumptions are drawn from available information and industry knowledge. Readers are advised that the content provided is for informational purposes only and should not be construed as an exact reflection of any company’s official policies or procedures. For precise and accurate details regarding a company’s employee handbook, individuals should refer directly to the company’s official documentation or consult with appropriate representatives.

Please be aware that the content on this page has been generated by using artificial intelligence language models and may contain errors, inconsistencies, or outdated information. It is provided as-is without any warranties or guarantees of accuracy. We strongly recommend using this content as a starting point for further research. We disclaim any liability for damages or losses resulting from the use or reliance on this content.