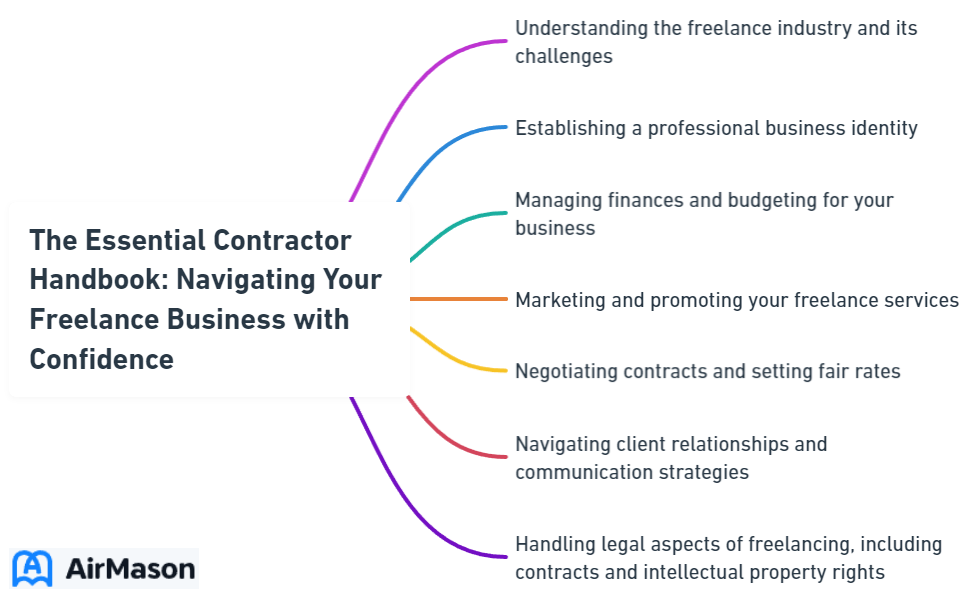

Seeking the blueprint for your freelance business? Dive into this contractor handbook to uncover key strategies for maintaining your independence, understanding contractor laws, and fostering a productive work environment. Step-by-step, we guide you through the essentials without the fluff.

Key Takeaways

- A contractor handbook is essential in setting expectations, providing guidelines distinct from employee handbooks, and should include onboarding practices and role-specific details while ensuring compliance with labor laws.

- Establishing and maintaining independent contractor status requires clarity in contracts, adhering to IRS guidelines, documenting transactions meticulously and understanding the legal implications of misclassification and tax reporting.

- Contractors should provide their own tools and equipment, manage a separate workspace, and maintain professional independence, while companies can offer job-specific resources and ensure a positive company culture for collaborative efficiency.

Employee Handbook Versions

Employee handbook versions are essential documents that outline the policies, procedures, and expectations within an organization. These versions serve as a guide for employees regarding their rights, responsibilities, and the company’s standards of conduct. Updating and maintaining various versions of the handbook is crucial to ensure alignment with current laws, regulations, and company practices. Additionally, different versions may be necessary to accommodate changes in organizational structure, industry standards, or employee feedback. Employers must clearly communicate any updates or revisions to ensure that employees are aware of the latest policies and procedures. Regular reviews and revisions of employee handbook versions help foster a positive work environment and promote compliance with legal requirements.

Creating a Contractor Handbook

Any independent contractor’s business relies heavily on a contractor handbook. It offers direction, instills company values, and provides vital work-related information. This handbook sets expectations and distinguishes between an organization’s employees and its contractors. Having a copy of your employee handbook can help contractors better understand their role in the company.

However, a contractor handbook should not mirror an employee handbook to avoid confusion and misclassification issues. Instead, an independent contractor handbook, sometimes referred to as a Contractor Standards Guide, should encapsulate the company’s mission, vision, and how contractors fit into the company’s goals.

Purpose of a Contractor Handbook

At its core, a contractor handbook offers:

- Direction regarding company culture

- Essential information needed for contractors to excel in their roles

- A go-to resource for frequently asked questions

- Company-specific details

- Contractor-related policies and rules

An organization demonstrates its commitment to structure and optimal contractor performance when it provides a contractor handbook.

Differences Between Employee and Contractor Handbooks

Differentiating between an employee and a contractor handbook is vital. A contractor handbook should provide guidelines and information relevant to the contractors’ role while avoiding any suggestion of an employment relationship. This is essential in ensuring the contractor handbook complies with labor laws, particularly in clarifying that the contractor is not an employee.

Unlike employee handbooks that offer a comprehensive guide to company rules, expectations, and culture, contractor handbooks avoid establishing a legally binding agreement.

Essential Components to Include

A contractor handbook should include provisions clarifying the contractor’s responsibilities to provide their own tools and equipment. Essential onboarding practices should be refined to avoid overwhelming contractors with information, ensuring a structured onboarding process and proper introduction to the safety culture.

Setting clear expectations and goals for independent contractors is integral. This understanding of project scopes, timelines, deliverables, and their roles creates a framework for subsequent feedback and helps in avoiding misunderstandings throughout the contractor engagement.

Establishing Independent Contractor Status

Managing a freelance business necessitates the establishment and maintenance of independent contractor status. Reviewing IRS criteria is necessary to ensure that the company is maintaining an independent contractor relationship. This involves thorough examination of the criteria set by the IRS. It is important to periodically review the contract and assigned scope of work. This will ensure that the contractor is maintaining independent status..

Moreover, maintaining transaction records like contractors’ invoices is of utmost importance.

Factors Determining Contractor Status

Determining contractor status requires understanding IRS guidelines. The IRS outlines three main categories for determining worker status:

- Behavioral control: This refers to whether the company has the right to direct and control how the worker performs the task for which they are hired.

- Financial control: This refers to whether the company has the right to control the financial aspects of the worker’s job, such as how they are paid and whether they can work for other companies.

- Type of relationship: This refers to the nature of the relationship between the worker and the company, such as whether there is a written contract and whether the worker receives benefits.

No single factor determines whether a worker is an employee or independent contractor, and the entirety of the relationship must be considered.

If the worker’s status as an independent contractor or employee is still unclear after evaluating these factors, Form SS-8 can be filed with the IRS for an official determination.

Importance of Clear Contracts

To prevent misunderstandings and classification risks when hiring independent contractors, clear written contracts are indispensable. These contracts should specify the scope of work in detail, including project deliverables, deadlines, acceptable final products, and a process for change management. Legal protections in contracts, such as insurance requirements, intellectual property rules, confidentiality clauses, and indemnity agreements, safeguard both parties.

Clearly defined termination conditions in the contract allow for a structured exit strategy if either party does not fulfill their contractual obligations.

Documentation and Record-Keeping

For independent contractors, professional success and legal protection hinge on effective documentation management. A robust contract should clearly outline:

- The scope of work

- Deliverables

- Timelines

- Payment terms

This will prevent misinterpretation and ambiguity by ensuring that information is correctly classified.

Regular updates to documentation such as contracts and invoices are best practices to reflect any changes in services, rates, or project scope. Platforms like Deel can streamline documentation management for independent contractors, enabling automation of invoicing, transaction management, and secure document storage.

Tools, Equipment, and Workspace

For independent contractors, the tools of the trade extend beyond the proverbial hammer and nail. Independent contractors are expected to provide their own tools and equipment necessary for completing their work. This typically includes:

- a computer

- work vehicle

- tools

- other necessary items for the job.

In addition to tools and equipment, independent contractors must also buy their own supplies and manage their own industry training.

Contractor-Owned Tools and Equipment

As captains of their own ships, contractors exercise independent control over their work and are responsible for their own tools and equipment. This underscores their independence and enhances productivity. While they bear the cost of their own business expenses upfront, contractors may bill the company for certain expenses as agreed in the contract.

However, the company should not pay contractor expenses directly; these should be included in the contractor’s overall job cost as outlined in the contract.

Company-Provided Access and Resources

While contractors shoulder the responsibility for their own tools, companies can offer job-specific training to guide them on work submission guidelines. A company may also require independent contractors to sign an agreement that includes details on the services rendered and the responsibilities of the company to the contractor and vice versa. This symbiotic relationship ensures that contractors are equipped with the knowledge necessary to excel in their roles.

Workspace Considerations

In addition to having their own tools and equipment, independent contractors are expected to maintain a separate workspace and professional business identity to reinforce their independent status. Setting up a workspace may involve meeting legal requirements, such as obtaining a tax registration certificate or business license.

Contractors value the autonomy and flexibility of contract work, and establishing clear collaboration styles and schedules can enhance productivity.

Legal and Compliance Considerations

Navigating the legal labyrinth of independent contractor status can be complex. When an organization has the legal right to control the details of how services are performed by a worker, the IRS may interpret this as constituting an employer-employee relationship based on their guidelines. Therefore, accurate worker classification is crucial.

Also, Form 1099-NEC must be sent each year to any contractor paid $600 or more for services provided during the year. Furthermore, retaining the W-9 form for four years is essential to adhere to legal and IRS requirements in case questions arise regarding the worker’s tax information or employment status.

Correctly Classifying Workers

Correctly classifying workers as employees or independent contractors is key to avoiding severe legal repercussions, including fines, liability for employment taxes, back pay for employee entitlements, and reputational damage. The ‘totality-of-circumstances’ test can help businesses evaluate multiple factors to determine whether a worker is an employee or an independent contractor.

Contracts play a crucial role in supporting independent contractor status, they should define the facts of the work arrangement, while avoiding behaviors that imply an employee relationship.

Workers’ Compensation and Insurance

Insurance considerations are pivotal when dealing with independent contractors. Contractors typically need to carry their own workers’ compensation insurance coverage as they are not generally covered by the hiring company’s policy. Employers may be liable for workers’ compensation claims made by independent contractors injured on the job depending on state laws.

An annual audit of a company’s workers’ compensation coverage can lead to increased insurance costs if there has been use of uninsured independent contractors without proper documentation.

Tax Implications and Reporting

Tax implications and reporting requirements for independent contractors can be complex but are essential to understand. Independent contractors are issued a 1099-NEC form by businesses if they are paid $600 or more for services during the tax year. Form 1099-NEC should be completed by the end of the year and sent to contractors by January 31 of the following year.

Penalties for not submitting a 1099-NEC can range from $50 to $290 per form depending on the lateness of the filing, up to $580 per form for intentional disregard.

Maintaining a Positive Company Culture

Maintaining a positive company culture is beneficial for both the company and the contractors. Providing contractors with a consistent onboarding experience just like full-time employees can boost their productivity and engagement.

Maintaining open communication with contractors, including setting clear expectations and being open to their ideas, contributes to a healthy company culture and successful contributions from all workers. Including contractors in company events and meetings can help them feel like part of the team.

Inclusion in Company Events and Communications

Inclusion plays an integral part in fostering a sense of belonging among contractors. The contractor handbook contains essential information such as parking details, facility access times, and company events schedule, which familiarize contractors with the company’s operations. Digital communication platforms are effective tools for including contractors in updates and regular company communications.

While contractors should be invited to meetings and included in event communications to promote inclusion, they are typically not allowed to attend certain events, such as company parties or special events for employees.

Balancing Autonomy with Collaboration

Balancing contractor autonomy with collaboration is key to achieving successful project outcomes. Contractors value autonomy as it aligns with their independent work style and enhances productivity. Micromanagement can undermine a contractor’s performance by diminishing their sense of independence.

However, while autonomy is essential, it’s important to combine it with collaboration to meet the objectives of the project efficiently.

Providing Feedback and Recognition

Feedback, benefiting both the contractor and the company, is a reciprocal process. Specific feedback is more effective than general comments and should point out particular behaviors or outcomes that have been beneficial or need improvement. Balancing positive information with constructive criticism helps contractors to feel appreciated and understand where they can advance.

Constructive feedback should be solution-focused, providing contractors with guidance on how to enhance their performance instead of merely highlighting faults.

Managing Disputes and Disciplinary Actions

Disputes and disciplinary action are inevitable in any business relationship. With the right approach, these can be effectively managed. Resolving performance issues with contractors should hinge on the written contract terms, not employee procedures.

It is recommended to attempt to resolve issues with contractors before moving towards termination as a potential solution.

Addressing Performance Issues

When performance issues arise, it’s essential to handle them with care. Resolution of such issues should be guided by the written contract terms. Before raising concerns, evaluate the significance of issues with a contractor to avoid terminating the relationship over minor problems.

Consideration of the associated costs and impact on the company’s bottom line is crucial when addressing contractor performance issues.

Resolving Disputes

Disputes can occur for various reasons, including:

- Misclassification

- Non-payment

- Disagreements over the scope of work

- Breach of contract

Open communication is often crucial for resolving misunderstandings or disputes without escalating to legal action, and it can help parties gain access to the information needed for resolution.

Alternative dispute resolution methods, such as mediation and arbitration, offer a neutral setting for parties to negotiate and can be more time and cost-effective than court proceedings.

Termination of Contract

Contract termination is a delicate process that requires careful consideration. Termination provisions in a written contract should clearly outline conditions for ending the working relationship, which may include:

- non-communication

- poor work quality

- missed deadlines

- contract breaches

Notice provisions should be specified in the contract, typically requiring 10-14 days of notice before contract termination, but sometimes longer periods are mandated.

Immediate contract termination is permissible without standard negotiation or notice in instances of criminal behavior or fraud by the contractor.

Updating Your Contractor Handbook

A contractor handbook, far from being a static document, evolves alongside the business. Regular audits ensure it remains in compliance with legal requirements and reflects organizational changes. Any updates should undergo legal review to ensure full compliance with laws and regulations and mitigate potential risks.

Additionally, effectively communicating any updates to contractors using clear language and summarizing the key updates ensures understanding.

Monitoring Regulatory Changes

Regulatory changes are part and parcel of the business landscape. Monitoring changes in laws and regulations, such as:

- labor laws

- discrimination

- health and safety

- employee rights

is necessary when updating a contractor handbook. Regularly reviewing and updating the contractor handbook helps contractors stay informed about their rights and responsibilities and demonstrates the company’s commitment to compliance.

Incorporating Industry Best Practices

Best practices are the gold standard in any industry. Regularly updating the contractor handbook is essential to maintain alignment with industry best practices and current standards.

Conducting an in-depth analysis of current contractor relationships against new regulatory criteria is crucial to ensure that updates to contractor policies reflect industry best practices.

Enterprise Car Rental Employee Handbook

The Enterprise Car Rental Employee Handbook serves as a comprehensive guide for employees, outlining policies, procedures, and expectations within the organization. This handbook covers essential topics such as company culture, customer service standards, safety protocols, and employee benefits. By familiarizing themselves with the contents of the Enterprise Car Rental Employee Handbook, employees can ensure compliance with company policies and contribute to a positive and productive work environment. Additionally, the handbook serves as a reference tool for employees to address any questions or concerns they may have regarding their roles and responsibilities within the organization.

Communicating Updates to Contractors

When updating your contractor handbook, communication is fundamental. Utilizing digital platforms such as email or an intranet ensures that contractors have easy access to the revised contractor handbook. Using a variety of delivery channels, like internal newsletters or team meetings, makes certain that contractors receive and comprehend policy updates.

Implementing a quiz or assessment after policy changes are communicated can confirm contractors’ understanding and adherence to new policies.

Summary

In summary, a well-crafted contractor handbook is an invaluable asset for independent contractors. It provides guidance, sets expectations, and fosters a sense of company culture. By adhering to legal and compliance considerations, maintaining a positive company culture, and effectively managing disputes and disciplinary actions, independent contractors can navigate their freelance business with confidence and poise.

Frequently Asked Questions

Can you have a handbook for contractors?

Yes, contractors should receive a well-crafted employee handbook to understand company policies and procedures, even though they may not be traditional employees.

Do standard operating procedures apply to independent contractors?

Yes, standard operating procedures can be tailored for independent contractors to ensure work integration and flexibility.

How does contracting work in UK?

Contracting in the UK involves taking full responsibility for business operations, managing work independently, bidding on own projects, submitting invoices, and handling insurance and taxes.

What are some legal and compliance considerations for independent contractors?

When hiring independent contractors, it’s important to focus on correctly classifying workers, adhering to insurance and workers’ compensation requirements, and understanding tax obligations. This will help ensure compliance with IRS guidelines and maintain proper documentation.

How can a positive company culture be maintained with independent contractors?

To maintain a positive company culture with independent contractors, it’s important to include them in company events and communications, balance their autonomy with collaboration, and provide constructive feedback and recognition. Regular communication and inclusion in company updates can foster a sense of belonging among contractors.

Important Disclaimer:

Please be aware that the content on this page has been generated by using artificial intelligence language models and may contain errors, inconsistencies, or outdated information. It is provided as-is without any warranties or guarantees of accuracy.

We strongly recommend using this content as a starting point for further research. We disclaim any liability for damages or losses resulting from the use or reliance on this content.