For those seeking an “ally financial employee handbook example”, this article serves as a direct peek into the company’s employee guide. Learn about the key policies, operational guidelines, and benefits that shape the experience of Ally Financial’s staff. We provide a targeted look at sections that can be found in an actual ally financial employee handbook example, without spoiling the comprehensive detail to come.

Key Takeaways

- The Ally Financial Employee Handbook is a detailed guide emphasizing the company’s core values of Looking Externally, Executing with Excellence, Acting with Professionalism, and Delivering Results, which inform its flexible work environment and extensive employee benefits.

- Ally Financial provides a wide range of benefits, including health and well-being programs, comprehensive financial benefits and incentives, and work-life balance arrangements such as flexible paid time off and remote working opportunities, demonstrating a strong commitment to employee satisfaction.

- Ally Financial maintains a steadfast commitment to diversity, inclusion, and equal opportunity employment, with active support for Employee Resource Groups (ERGs) and robust policies that foster a workplace respectful of varied backgrounds and identities.

Fortune 100 Company Employee Handbook

Welcome to our esteemed Fortune 100 Company, where excellence and innovation thrive. This employee handbook serves as your comprehensive guide to navigating the various policies, procedures, and benefits that define our workplace. At the heart of our commitment to success is the “Fortune 100 Company Employee Handbook,” meticulously crafted to provide you with the necessary insights into our organizational culture and expectations. As you embark on your journey with us, we encourage you to familiarize yourself with this invaluable resource, ensuring a harmonious and productive collaboration. Your adherence to the guidelines outlined in the “Fortune 100 Company Employee Handbook” plays a pivotal role in sustaining our reputation as an industry leader and a great place to work.

Understanding the Ally Financial Employee Handbook

The Ally Financial Employee Handbook is a comprehensive guide for employees, outlining the company’s operations, values, and benefits. This guide prioritizes doing things right, thereby helping employees maximize their career and personal life satisfaction. The handbook is steeped in the company’s LEAD core values, which include:

- Looking Externally

- Executing with Excellence

- Acting with Professionalism

- Delivering Results

These values are integral to the company, Ally Financial, driving its commitment to creating a flexible work environment that caters to the personal needs of its employees.

Indeed, Ally Financial’s dedication to flexibility is reflected in the fact that a remarkable 93% of employees feel that they have the ability to take time off when necessary. This sense of flexibility is not just confined to time-off policies, but is also reflected in the financial and other benefits offered by Ally Financial. From health and wellbeing benefits to financial incentives and work-life balance perks, the Employee Handbook is a goldmine of resources designed to support employees in their personal and professional lives.

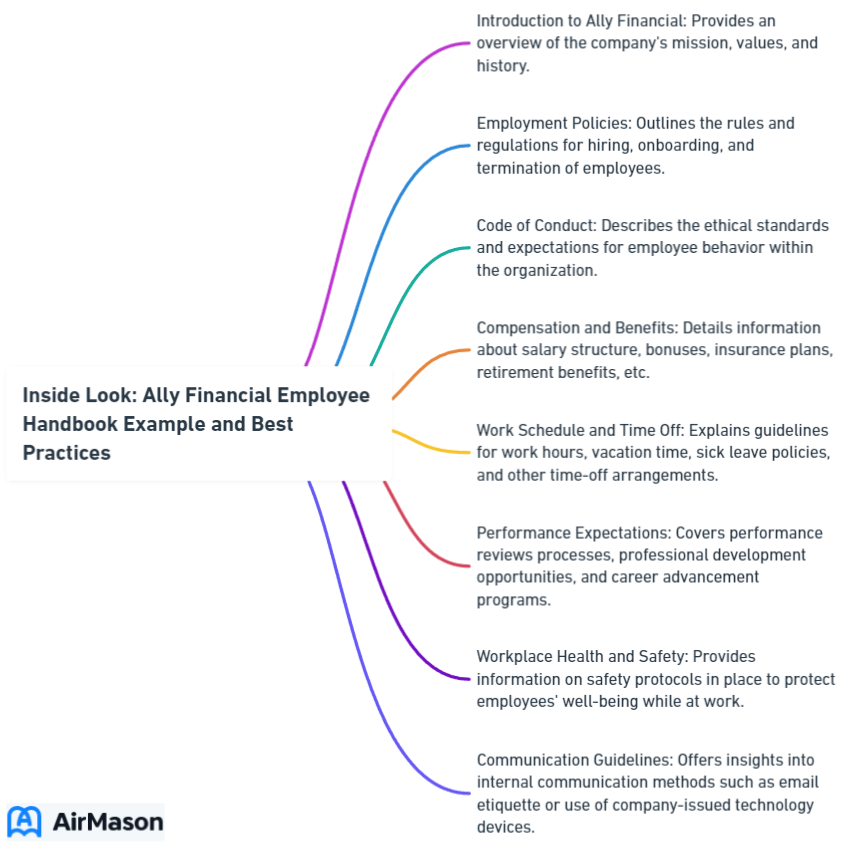

Key Sections in the Handbook

What contents does the Ally Financial Employee Handbook include? The handbook is a treasure trove of information, with key sections focusing on the Code of Conduct and Ethics, as well as the Board of Directors Governance Guidelines. The Code of Conduct and Ethics document, in particular, is a comprehensive guide that details the rights and responsibilities of employees. This 36-page document is a testament to the depth of information provided to Ally Financial Inc.’s employees, ensuring they are well-versed in the company’s ethical guidelines and expectations.

In addition to these critical sections, the handbook also includes valuable information about the employee welfare benefit plan offered by the company. This includes details about the various benefits available to employees, ranging from health and wellbeing perks to financial incentives. This information is vital in helping employees understand the full spectrum of benefits offered by Ally Financial, enabling them to make informed decisions about their personal and professional lives. The initial benefit determination process plays a crucial role in this regard.

Navigating the Handbook

The clear headings and well-structured sections make navigating the Ally Financial Employee Handbook effortless. The handbook has been designed to make it easy for employees to efficiently locate relevant information. This user-friendly design is complemented by:

- A handy table of contents

- A search function

- An index

- A glossary

All of these features make it easier for employees to access specific details, such as the plan’s annual financial report, related release document limits, and that such participant files, if such an extension is needed for further analysis.

The handbook is divided into several key sections, including Policies, Code of Conduct & Ethics, Bylaws, Board of Directors Governance Guidelines, and information pertaining to employee benefits. These sections cover a wide range of topics, such as retirement savings plans, base pay, incentive programs, and paid time off days. This comprehensive structure ensures that employees have easy access to all the information they need, whether it’s about their benefits, company policies, or other personal planning.

Employee Benefits at Ally Financial

Ally Financial doesn’t just provide jobs to its employees. It offers a comprehensive array of benefits designed to support employees in all aspects of their lives, from their health and wellbeing to their financial stability and work-life balance. As an employee benefits ally financial, the company’s dedication to offering such comprehensive benefits is evident in its adherence to the guidelines set by the Financial Industry Regulatory Authority (FINRA), ensuring best practices in employee benefits.

These benefits go beyond merely meeting the basic requirements. They are designed to support employees in the corporate finance business. For example, Ally Financial offers a range of financial benefits and incentives, such as:

- Student loan repayment

- 529 plan contributions

- An industry-leading 401(k) retirement savings plan

- Pay-for-performance incentives (bonuses)

- Flexible paid-time-off

- Volunteer time off

By offering such comprehensive and thoughtful benefits, Ally Financial demonstrates its commitment to the wellbeing and satisfaction of its employees.

Health and Well-being Benefits

Ally Financial covers all aspects when it comes to health and well-being benefits. The company offers:

- A comprehensive well-being program

- Resources and support for emotional well-being

- Flexible health insurance options, including dental and vision coverage

In adherence with the guidelines set by the Employee Benefits Security Administration (EBSA), Ally Financial ensures that its benefits comply with federal regulations, thereby offering the best possible support to its employees, including ally supplemental benefits prior to any changes in regulations.

In addition to physical health benefits, Ally Financial also places a strong emphasis on mental health. The company offers emotional well-being resources, including access to up to 16 free counseling sessions with mental health providers. This focus on mental health is complemented by a comprehensive well-being program that encompasses emotional well-being resources and support, alongside medical, dental, and vision insurance options. All of this is part of Ally Financial’s commitment to ensuring that its employees are well taken care of, both physically and mentally.

Community Health Systems Employee Handbook Example

In the comprehensive Community Health Systems Employee Handbook Example, employees gain valuable insights into the organization’s policies, procedures, and expectations. This handbook serves as a vital resource, providing a detailed roadmap for navigating the workplace environment. Community Health Systems prioritizes the well-being and success of its employees, and this handbook reflects the commitment to fostering a healthy and collaborative work atmosphere. From code of conduct to benefits information, the handbook encapsulates crucial information that empowers employees to thrive within the Community Health Systems community. As a guidebook for professional conduct and growth, the Community Health Systems Employee Handbook Example plays a pivotal role in shaping a positive and inclusive work culture.

Financial Benefits and Incentives

Being a financial institution, Ally Financial comprehends the significance of financial well-being. This understanding is reflected in the company’s extensive array of financial benefits and incentives. These include competitive base pay, an industry-leading 401(k) retirement savings plan, and generous bonuses that are linked to an individual’s position and performance. For example, analysts receive an average bonus of $6,471, while managers typically receive around $22,438.

But that’s not all. In addition to these financial benefits, Ally Financial also offers annual stock awards, which are contingent upon the company’s financial performance and board evaluations. The company also provides access to various retirement plans, including a top-tier 401(k) plan and three types of IRA plans: Traditional IRA, Roth IRA, and SEP IRA. Together, these financial benefits and incentives demonstrate Ally Financial’s commitment to supporting its employees’ financial well-being and future security.

Work-Life Balance Benefits

Ally Financial acknowledges that work forms only a part of life. That’s why the company goes to great lengths to facilitate work-life balance for its employees. Through its comprehensive well-being program, emotional well-being resources, and a strong emphasis on promoting a healthy work/life balance, Ally Financial ensures that its employees are able to manage their professional responsibilities without compromising on their personal lives. The company encourages employees to take regular breaks, use their vacation days, and leave work on time, fostering a healthy work-life balance.

In addition to these policies, Ally Financial also provides a range of flexible work arrangements, such as:

- remote working opportunities

- work from home options

- flexible hours

- telecommuting

- compressed workweeks

- flexible scheduling

These arrangements ensure that employees can tailor their work schedules to their personal needs. The company also offers a generous 20 flexible paid time off days, further demonstrating its commitment to supporting a healthy work-life balance.

Ally Financial’s Commitment to Diversity and Inclusion

In the current globalized era, the significance of diversity and inclusion cannot be overstated. Recognizing this, Ally Financial is deeply committed to fostering a diverse and inclusive workplace. The company has put in place a range of policies and initiatives to support all employees, regardless of their background. These measures uphold the principles of fairness and equality, ensuring that all employees feel valued and supported.

This commitment to diversity and inclusion exceeds merely meeting the basic standards. Ally Financial actively promotes diversity through its support for Employee Resource Groups (ERGs), which provide networking, support, and development opportunities for employees from diverse backgrounds. Over the past year, over 40% of employees actively participated in ERGs at Ally Financial, reflecting the company’s commitment to fostering a diverse and inclusive workplace.

Equal Employment Opportunity

As an equal opportunity employer, Ally Financial is committed to providing equal employment opportunities to all qualified applicants and employees. This commitment is reflected in the company’s policies, which prohibit discrimination on the basis of:

- age

- race

- color

- sex

- religion

- national origin

- disability

- sexual orientation

- gender identity or expression

- pregnancy status

- marital status

- military or veteran status

- genetic information

- any other characteristic protected by law, including other applicable federal law.

Ally Financial’s commitment to equal employment opportunity extends beyond hiring policies. The company also ensures fairness in promotions and career advancements for those in the same or similar job through the establishment of clear, merit-based expectations and criteria. This approach ensures that all employees are given fair and equal opportunities to grow and advance in their careers, regardless of their background or personal circumstances.

Supporting Employee Resource Groups (ERGs)

At Ally Financial, Employee Resource Groups (ERGs) play a crucial role in promoting diversity and inclusion. These groups provide a platform for employees from diverse backgrounds to connect, support each other, and develop professionally. Ally Financial has a variety of ERGs, including:

- Black and Hispanic groups

- LGBTQ+ group

- Veterans group

- Generational group

These groups offer networking, support, and development opportunities, thereby fostering a diverse and inclusive workplace.

Ally Financial provides strong support for its ERGs, offering a secure environment for discussions and education on diversity. Each ERG is designated a focus month during which extra activities and events are organized to commemorate and recognize that particular group. Through these measures, Ally Financial ensures that its ERGs are empowered to effect constructive change and foster a diverse and inclusive work environment.

Accommodations for Employees with Disabilities

In addition to fostering diversity and inclusion, Ally Financial is also committed to providing accommodations and support for employees with disabilities. The company ensures that all employees, regardless of their physical or mental abilities, have equal access to opportunities and resources. This commitment is reflected in the company’s policies, which provide accommodations and support for employees with disabilities.

For employees with disabilities, Ally Financial offers a range of accommodations and supports. The company is dedicated to collaborating with and offering reasonable accommodations to employees with physical or mental disabilities. In the event of a disability, individuals can request accommodations at Ally Financial by sending their accommodation request to work@ally.com. By providing these accommodations, Ally Financial ensures that all employees are able to contribute to their full potential, regardless of any physical or mental disabilities.

Compliance and Ethics at Ally Financial

Compliance and ethics form the core of Ally Financial’s operations. The company places a strong emphasis on maintaining a responsible and ethical workplace, as reflected in its Code of Conduct and Ethics. This code, applicable to all employees, is based on fundamental principles such as:

- Integrity

- Accountability

- Respectful treatment of others

- Promotion of diversity and inclusion

To ensure adherence to these principles, Ally Financial has put in place a robust system for reporting concerns and violations. Employees are encouraged to report any integrity or compliance concerns, and the company prohibits any form of intimidation or retaliation against whistleblowers. This system ensures that any concerns or violations are promptly addressed and resolved, thereby maintaining the integrity and ethical standards of the company.

Regeneron Pharmaceuticals Employee Handbook Example

At Regeneron Pharmaceuticals, the Employee Handbook sets the standard for our workplace policies and practices. The Regeneron Pharmaceuticals Employee Handbook example serves as a comprehensive guide, outlining the company’s values, expectations, and procedures. This document is a crucial resource for employees, providing insights into everything from company culture to specific HR policies. By referencing the Regeneron Pharmaceuticals Employee Handbook example, our workforce gains clarity on their rights, responsibilities, and the overall framework that defines our professional environment. As an integral part of our commitment to transparency and effective communication, this handbook exemplifies the principles that drive our organization forward.

Code of Conduct

The Code of Conduct is central to Ally Financial’s commitment to compliance and ethics. This code serves as a guide for all employees, outlining the expected behaviors and ethical standards. The code promotes:

- Ethical behavior

- Accountability

- Transparency

- Respect within the company and in the communities it serves

- Advancement of equity

- Fostering an owner’s mindset

To ensure compliance with the Code of Conduct, Ally Financial has put in place measures to enforce the code and address any violations. These measures include the payment of damages to affected consumers and the imposition of civil money penalties. These consequences for violations demonstrate Ally Financial’s commitment to maintaining a responsible and ethical workplace.

Reporting Concerns and Violations

To maintain its high ethical standards, Ally Financial has put in place a robust system for reporting concerns and violations. Employees can report concerns and violations by contacting the Ally fraud hotline or utilizing the Online or Mobile Banking platform. This system ensures that any concerns or violations are promptly addressed, thereby maintaining the integrity of the company.

Ally Financial is committed to maintaining an open and transparent work environment. To this end, the company has implemented whistleblower protections to safeguard individuals who report misconduct in good faith. The company also ensures that employees are protected from any form of retaliation for reporting concerns or violations. This commitment to openness and transparency is a key part of Ally Financial’s commitment to compliance and ethics.

Training and Education

To ensure that all employees understand and adhere to its compliance and ethics standards, Ally Financial provides ongoing training and education. The company’s compliance and ethics training program includes:

- Maintaining accurate business records

- Legal awareness

- Enterprise compliance education

- Processes for reporting integrity or compliance concerns

This comprehensive training program ensures that employees are well-equipped to uphold the company’s high ethical standards.

In addition to these training programs, Ally Financial also offers a variety of learning opportunities to support employees’ understanding of compliance and ethics. These include:

- Interactive games

- Life simulators

- Online courses

- Other engaging methods

Through these initiatives, Ally Financial ensures that its employees are well-versed in the company’s compliance and ethics standards, thereby maintaining a responsible and ethical workplace.

Career Growth and Development Opportunities

Employee career growth and development hold a top priority at Ally Financial. The company is committed to supporting its employees in their professional growth, offering a range of programs and initiatives to facilitate career progression. From performance management and feedback processes to learning and development programs and internal mobility options, Ally Financial provides numerous opportunities for employees to advance in their careers.

In addition to these career development opportunities, Ally Financial also offers specific talent programs such as the Ally Accounting LEADership Development Program (ALDP) and the Audit Talent Development Program. These programs are designed to accelerate specialized career tracks for employees, further demonstrating Ally Financial’s commitment to supporting employee career growth and development.

Performance Management and Feedback

Ally Financial supports employee career growth with robust performance management and feedback mechanisms. These processes are designed to help employees identify their strengths and areas for improvement, thereby facilitating their professional development. Managers at Ally Financial play a crucial role in these processes, leading the creation of new analysis, ensuring top performers are identified and promoted, and overseeing the employee experience and business processes.

In addition to these performance management processes, Ally Financial also promotes continuous feedback. Employees are encouraged to provide feedback during quarterly one-on-one meetings, fostering a culture of open and transparent communication. This approach ensures that employees receive regular feedback on their performance, enabling them to continuously improve and grow in their roles.

Learning and Development Programs

Further enhancing employee career growth, Ally Financial provides a variety of learning and development initiatives. These programs offer opportunities for skill-building and professional growth, including:

- Leadership training

- Personalized planning for mobility and advancement

- Rewards and recognition programs

- Tuition reimbursement

For instance, the company provides a tuition reimbursement program, offering up to $10,000 per year from a special or separate fund as a part of its dedication to learning and development.

In addition to these learning and development programs, Ally Financial also organizes events such as FutureFest, an enterprise-wide innovation competition that encourages employees to develop creative solutions to business challenges. This event fosters a culture of learning and skill enhancement, further demonstrating Ally Financial’s commitment to supporting employee career growth and development.

Internal Mobility and Job Rotation

To provide employees with diverse learning experiences and support their career development, Ally Financial facilitates internal mobility and job rotations. Through programs like the Auto Finance Accelerated Rotational Program (DRIVE) and the Early Talent Data and Analytics Talent Development Program, employees have the opportunity to gain experience across various areas within the company.

Additionally, Ally Financial offers tailored career paths that encompass a range of responsibilities and provide employees with the chance to engage with various tools and routines. These career paths enable employees to explore different roles and departments within the company, thereby fostering diverse learning experiences and supporting career development.

APA Employee Handbook Example

In this illustrative APA employee handbook example, organizations can find a comprehensive framework for establishing policies and guidelines. The APA employee handbook example serves as a valuable reference, showcasing best practices in crafting clear, concise, and compliant documentation for workforce management. Employers can leverage this model to address key areas such as code of conduct, employee benefits, and organizational policies. By examining the APA employee handbook example, businesses can gain insights into effective communication, legal compliance, and the promotion of a positive workplace culture. This exemplar not only provides a template for structuring essential information but also emphasizes the importance of adapting guidelines to the specific needs of the organization.

Summary

In conclusion, Ally Financial is a company that truly understands the value of its employees. From its comprehensive Employee Handbook and wide range of employee benefits to its commitment to diversity and inclusion, compliance and ethics, and career growth and development, Ally Financial goes above and beyond to support its employees in every aspect of their lives. It is no wonder that the company boasts an impressive 90% employee satisfaction rate. With its commitment to doing right by its employees, Ally Financial stands as a shining example of how companies should treat their most valuable asset – their people.

Frequently Asked Questions

Is Ally Financial a good company?

Yes, Ally Financial is considered a good company, with 90% of employees saying it is a great place to work, and an overall rating of 3.7 out of 5 based on employee reviews.

Why do you want to work for Ally Financial?

I want to work for Ally Financial because of the meaningful and challenging projects, as well as the inclusive culture that fosters positive change in and outside the workplace. The focus on diversity and inclusion at Ally is a key factor in my interest in working for the company.

What are the ethics of Ally?

The ethics of being an ally require humility, intentionality, and critical thinking to avoid performative and dysfunctional rescuing. It has evolved in response to increased attacks on marginalized communities.

What is the Ally Financial Employee Handbook?

The Ally Financial Employee Handbook serves as a detailed resource for employees, covering company policies, benefits, and expectations to support their professional and personal well-being.

What health and well-being benefits does Ally Financial offer?

Ally Financial offers a comprehensive well-being program with resources for emotional well-being and flexible health insurance options, including dental and vision coverage. This can greatly benefit employees in maintaining their health and well-being.

Important Disclaimer:

The article presented here does not serve as a representation of the company’s actual employee handbook mentioned in this article.

Our discussions and insights regarding employee handbook are based on assumptions about what may be considered significant in the companies’ policies. These assumptions are drawn from available information and industry knowledge. Readers are advised that the content provided is for informational purposes only and should not be construed as an exact reflection of any company’s official policies or procedures. For precise and accurate details regarding a company’s employee handbook, individuals should refer directly to the company’s official documentation or consult with appropriate representatives.

Please be aware that the content on this page has been generated by using artificial intelligence language models and may contain errors, inconsistencies, or outdated information. It is provided as-is without any warranties or guarantees of accuracy. We strongly recommend using this content as a starting point for further research. We disclaim any liability for damages or losses resulting from the use or reliance on this content.