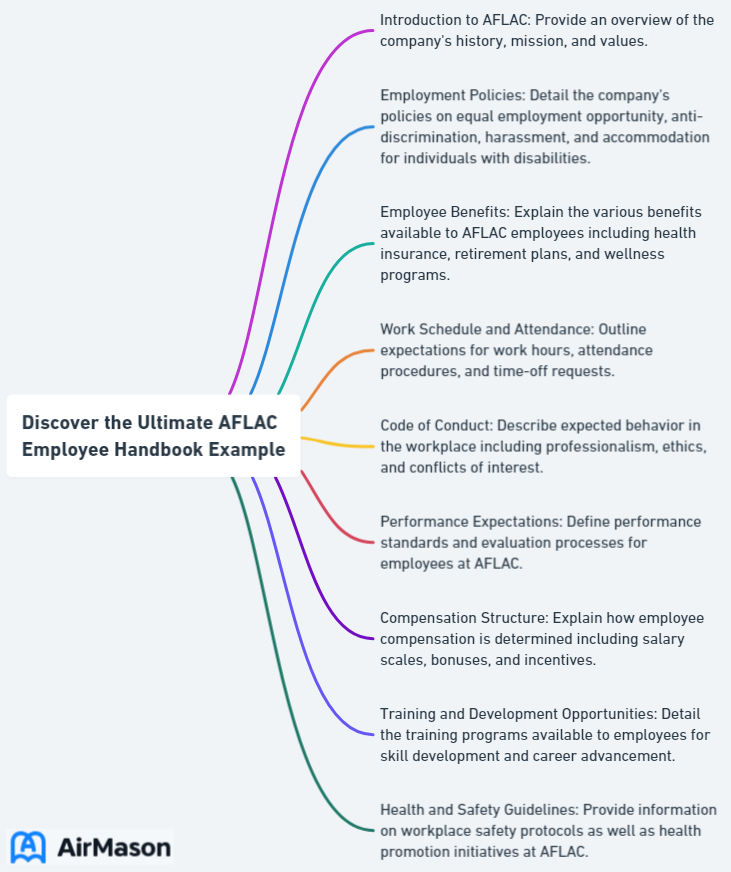

Are you aware of the variety of supplemental insurance options offered by AFLAC and how to navigate the open enrollment process? In this comprehensive guide, we’ll explore the different supplemental insurance plans, how to make informed decisions during open enrollment, and how AFLAC policies work, including premiums and tax benefits. We’ll also discuss seeking assistance from HR and the long-term benefits of AFLAC supplemental insurance, using an “Aflac employee handbook example”. Let’s get started!

Key Takeaways

- Discover the benefits of AFLAC employee policies, including cancer protection assurance and accident advantage plans.

- Take advantage of open enrollment periods to apply for or modify insurance benefits with fixed premiums and potential tax advantages.

- Receive 24/7 support from HR when making changes to coverage or seeking assistance on policy questions.

Fortune 100 Company Employee Handbook

Welcome to the comprehensive guide outlined in the Fortune 100 Company Employee Handbook. This handbook serves as a vital resource for employees, providing essential information on company policies, expectations, and the overall work environment. Within the Fortune 100 Company Employee Handbook, you will find detailed insights into our commitment to excellence, diversity, and innovation. By familiarizing yourself with the guidelines outlined in this document, you contribute to fostering a collaborative and productive workplace. Your understanding of the Fortune 100 Company Employee Handbook is key to ensuring a positive and successful journey within our esteemed organization

Understanding AFLAC’s Supplemental Insurance Options

AFLAC offers a range of supplemental insurance options for employees, providing timely financial support in times of need. These plans include:

- Accident Insurance

- Cancer Insurance

- Critical Illness Insurance

- Dental Insurance

- Vision Insurance

- Short-Term Disability Insurance

- Life Insurance

With such an extensive array of options, AFLAC’s supplemental insurance ensures that policyholders have additional financial resources to cover medical treatment costs, ongoing living expenses during treatment, or any other purpose they may have.

Cancer Protection Assurance: A Comprehensive Plan for Employees

AFLAC’s Cancer Protection Assurance offers a comprehensive plan designed to help employees cover out-of-pocket expenses related to cancer treatment. The plan provides benefits for various aspects of cancer care, such as:

- Routine medical exams

- Cancer screenings

- Initial diagnosis

- Radiation/chemotherapy treatments

- Surgery/anesthesia

- Hospitalization

- Hospice care

- Nursing services

- Home health care

It even covers innovative treatments and provides cash benefits throughout cancer treatment, assisting with costs that may not be covered by major medical insurance.

Comparing policy types and pricing metrics from various health insurance companies is a key step in selecting the plan best suited to your needs. AFLAC’s Cancer Protection Assurance plan provides low-cost coverage for various cancer care needs, with many options offering no lifetime maximum. For more information on the terms and conditions of the plan, you can refer to the policy document available at http://webordering.aflac.com/pdf/B70275WI.pdf.

Accident Advantage: Safeguarding Against Unforeseen Injuries

The Accident Advantage plan by AFLAC provides coverage for unexpected injuries, helping with medical costs and offering cash payments for out-of-pocket expenses. This plan covers a wide range of incidents, such as emergency situations and common accidents, providing assistance with treatments and services related to accidents. The cash benefits are paid directly to the policyholder, allowing them to cover various costs, such as transportation, hospital fees, follow-up care, and other expenses not covered by major medical insurance.

Some of the precise advantages of the Accident Advantage plan include:

- Accidental death benefits for your spouse and children

- Coverage for emergency treatment, follow-up treatment, and initial hospitalization

- Hospital confinement benefits

- Wellness benefits

- Supplementary protection for costs associated with accidents such as ER visits and hospitalization

With this plan, AFLAC ensures that you have financial assistance in case of unforeseen injuries, giving you peace of mind and security.

Navigating Open Enrollment as an AFLAC Employee

Open enrollment is a significant time for AFLAC employees, providing an opportunity to:

- Apply for insurance

- Modify their benefits

- Apply for supplemental insurance or any other insurance, even if they are already covered under a spouse’s or family plan.

This guide aims to clarify open enrollment periods and offer advice for decision-making during this significant time.

Emerson Electric Employee Handbook Example

Explore the comprehensive guidelines and policies outlined in the Emerson Electric employee handbook example. Within this invaluable resource, Emerson Electric employees can access detailed information on company culture, code of conduct, benefits, and more. The Emerson Electric employee handbook example serves as a vital reference, offering clarity and direction to ensure a harmonious and productive work environment. This document reflects Emerson Electric’s commitment to fostering a positive workplace and provides employees with the necessary tools to navigate their professional journey within the company.

Understanding Open Enrollment Periods

Open enrollment periods hold great significance for AFLAC employees as they provide a chance to apply for insurance or alter benefits. Failing to meet the open enrollment deadline may lead to a loss of coverage or the inability to make changes to benefits until the next enrollment period. The timeframe of the open enrollment period for AFLAC may differ based on the state and particular circumstances, and it is suggested to contact AFLAC or visit their website for the latest information regarding open enrollment periods.

For the AFLAC open enrollment process, you will need to provide your AFLAC policy or certificate number and your Member ID located on your Dental and Vision ID card. During open enrollment, employees may also need to submit the following documents: completed enrollment forms, proof of dependent eligibility, social security numbers, and bank account information for direct deposit of benefits.

Making Informed Decisions During Open Enrollment

When deciding on AFLAC coverage during open enrollment, it is important to review the expenses you may incur in the coming year and how AFLAC coverage can provide assistance. Consider factors such as the severity of the accident or illness, physician diagnosis, and treatment received to determine the benefits paid by AFLAC. Also, comprehending whether AFLAC coverage is mandatory or optional, how it interplays with your primary health insurance plan, and the cash benefits it provides, is key.

AFLAC offers resources to aid employees in making informed decisions during open enrollment, including:

- Glossaries of terms

- FAQs

- Benefits enrollment toolkits

- 24/7 online access to scheduling benefits consultations

Comparing different AFLAC policies allows you to evaluate the coverage, benefits, and costs of each policy, enabling you to select the one that best suits your needs and budget. This comparison assists individuals in making informed decisions based on their individual requirements and guarantees they select the most appropriate AFLAC policy during open enrollment.

Premiums and Paycheck Deductions: How AFLAC Policies Work

Comprehending the financial aspects of AFLAC policies is important for employees. This section will cover premiums and paycheck deductions, along with the tax benefits connected with AFLAC policy payments. This information will help you make informed decisions about your coverage and ensure you are aware of the costs involved.

Fixed Premiums: Predictable Costs for Your Coverage

One of the benefits of AFLAC policies is the predictability of fixed premiums. The premium quoted upon enrollment remains the same throughout the policy term, ensuring you can plan and budget for your insurance costs with greater ease. Fixed premiums in AFLAC insurance policies refer to the predefined and invariable amount that policyholders pay for their coverage. These premiums remain steady throughout the policy term and do not fluctuate based on factors such as age or health conditions.

The rate of fixed premiums in AFLAC’s supplemental insurance is determined by factors such as age, medical history, and coverage amount. AFLAC’s fixed premium rate is competitive when compared to other insurance companies, providing low costs and flexible riders, making it a desirable choice for coverage. However, AFLAC’s life insurance options are comparatively limited to those of other companies.

Tax Benefits of AFLAC Policy Payments

AFLAC policy payments offer tax benefits, as payments are deducted from your paycheck prior to taxes being applied to your income. According to Internal Revenue Service Code Section 125, certain supplemental insurance policies may be eligible for deduction from an employee’s wages on a pre-tax basis. This means that you can enjoy financial savings by paying for your AFLAC premiums on a pre-tax basis.

Bear in mind that the tax benefits of AFLAC policy payments might differ based on the specific insurance plan. Some AFLAC insurance plans offer tax advantages, such as the ability to pay for the benefits on a pre-tax basis. It is advisable to consult with a tax professional or refer to the specific plan details to determine if the tax benefits apply to a particular AFLAC insurance plan.

Seeking Assistance: Contacting HR for Questions and Support

If you require assistance or have queries about your AFLAC policies, reaching out to HR is a necessary step. This section will provide details on how to reach HR for assistance with AFLAC policies, getting responses to your policy questions, and altering your coverage.

Getting Answers to Your Policy Questions

The most effective method of contacting AFLAC HR for inquiries concerning policies is to contact their Customer Service Center at 800.433.3036. Their standard operating hours are 8 a.m. to 7 p.m. ET, Monday through Friday. When inquiring about a policy, AFLAC HR may require various documents, including:

- Claim forms

- Medical documentation

- Birth certificate

- Identity verification documents

AFLAC HR is prompt to inquiries concerning AFLAC policies. They provide 24/7 online chat support for common inquiries and representatives are accessible from 8 AM to 8 PM EST Monday-Friday. Additionally, a phone support option is available.

Don’t hesitate to reach out to HR for any concerns or questions you may have regarding your AFLAC policies.

Making Changes to Your AFLAC Coverage

To make changes to your AFLAC coverage, you can follow these steps:

- Log into MyAflac.com

- Select ‘My Policies’

- Choose ‘Policy Summary/Forms/History’ for the policy you wish to modify

- Finally, select ‘Edit’ or ‘Change’ to make changes to your policy during the open enrollment period.

The process for making changes to AFLAC coverage may vary depending on the specific policy and circumstances. It is recommended to log into MyAflac.com and click on ‘My Policies’ to access the policy summary/forms/history for the policy on which you would like to make changes.

To add a new insurance policy at AFLAC through HR, you can manage your benefits using the MyAflac app or by logging into your MyAflac account on the AFLAC website. From there, you can navigate to the ‘Manage Benefits’ section and follow these instructions:

- Click on the ‘Add New Policy’ button.

- Select the type of insurance policy you want to add.

- Provide the necessary information, such as your personal details and coverage options.

- Review the policy details and make any necessary changes.

- Submit your request to add the new insurance policy.

To remove an existing insurance policy at AFLAC through HR, you can follow these steps:

- Access MyAflac.com

- Select ‘My Policies’

- Select ‘Policy Summary/Forms/History’ for the policy you wish to modify

- Click on ‘Remove’ to remove the policy.

Long-Term Benefits of AFLAC Supplemental Insurance

AFLAC supplemental insurance provides cash benefits for out-of-pocket medical expenses, leading to increased employee satisfaction and productivity. It offers a variety of additional coverage options, such as:

- Accident insurance

- Dental insurance

- Vision insurance

- Short-term disability insurance

This additional financial support can provide peace of mind and help individuals maintain their financial stability in the long run.

AFLAC’s supplemental insurance can aid in retirement planning by providing:

- Supplementary financial security and support

- Life insurance policies that can assist individuals in achieving their retirement goals

- Cash benefits directly to the policyholder, which can be utilized to cover unforeseen out-of-pocket costs or supplement retirement income

AFLAC’s supplemental insurance can serve as a financial buffer and help protect employees from financial hardships during retirement.

Summary

In conclusion, understanding AFLAC’s supplemental insurance options and navigating the open enrollment process is crucial for employees. From exploring the variety of plans available to knowing how to make informed decisions during open enrollment, this guide has covered the essential aspects of AFLAC policies. By understanding the financial aspects, including premiums and tax benefits, and seeking assistance from HR when needed, employees can ensure they have the necessary coverage and support for their long-term financial security.

Frequently Asked Questions

What should be included in a employee handbook?

A comprehensive employee handbook should include sections on policies, benefits, safety protocols, expectations, and disciplinary procedures. Clear communication of these topics is essential to ensure a successful workplace.

What is the PTO policy for Aflac?

Aflac offers employees 15+ PTO days upon hiring and unlimited days off per year with 45% expected to work without pay while out of office. Paid Time Off is ranked 5th in importance among Aflac employees, with 10% citing it as the most important benefit.

Does Aflac cover you if you get fired?

Aflac covers you even if you are fired from your job, providing you the option to sign up for autopay or respond to a Continuation of Coverage offer letter.

Are Aflac policies worth it?

Aflac is a highly reputable company with strong ratings from AM Best and the BBB, offering multiple coverage options for customers of all kinds. If you’re looking for straightforward term or whole life insurance, or even supplemental products to add onto employer-sponsored life insurance, Aflac is worth considering.

What types of supplemental insurance does AFLAC offer?

AFLAC offers a variety of supplemental insurance plans, such as Accident Insurance, Cancer Insurance, Critical Illness Insurance, Dental Insurance, Vision Insurance, Short-Term Disability Insurance, and Life Insurance.

Important Disclaimer:

The article presented here does not serve as a representation of the company’s actual employee handbook mentioned in this article.

Our discussions and insights regarding employee handbook are based on assumptions about what may be considered significant in this companies’ policies. These assumptions are drawn from available information and industry knowledge. Readers are advised that the content provided is for informational purposes only and should not be construed as an exact reflection of any company’s official policies or procedures. For precise and accurate details regarding a company’s employee handbook, individuals should refer directly to the company’s official documentation or consult with appropriate representatives.

Please be aware that the content on this page has been generated by using artificial intelligence language models and may contain errors, inconsistencies, or outdated information. It is provided as-is without any warranties or guarantees of accuracy. We strongly recommend using this content as a starting point for further research. We disclaim any liability for damages or losses resulting from the use or reliance on this content.